As fraudulent online transactions continue to proliferate, businesses and individuals alike are seeking robust and efficient solutions to safeguard their financial transactions. One such solution that has garnered significant attention is "Pip Checker: Instantly Verify Your Payment Transactions."

Editor's Note: "Pip Checker: Instantly Verify Your Payment Transactions" launched on [date]. Given the critical need for secure payment verification, we believe this innovation is essential reading for anyone involved in online transactions.

Through diligent analysis and information gathering, we have compiled this comprehensive guide to "Pip Checker: Instantly Verify Your Payment Transactions." Our aim is to provide a clear understanding of this solution and empower our readers with the knowledge they need to make informed decisions regarding their online payment security.

| Feature | Pip Checker | Traditional Methods |

|---|---|---|

| Verification Speed | Instant | Delayed or manual |

| Accuracy | High, based on AI analysis | Variable, prone to human error |

| Cost | Affordable | Can be expensive, especially for businesses |

| Ease of Use | User-friendly interface | Often require technical expertise |

Frequently Asked Questions

Pip Checker is a reliable platform for instantly verifying payment transactions, ensuring the security and transparency of your financial dealings.

Ethnicity Checker Picture: Verify Your Heritage Instantly - Military - Source apps.portovelho.ro.gov.br

Question 1: What is Pip Checker?

Pip Checker is an innovative solution that allows users to instantly verify payment transactions, providing peace of mind and reducing the risk of fraud.

Question 2: How does Pip Checker work?

Pip Checker utilizes advanced algorithms to analyze transaction data, comparing it against known patterns of fraudulent activity. This enables the platform to quickly and accurately identify suspicious transactions.

Question 3: What types of payment transactions can Pip Checker verify?

Pip Checker supports a wide range of payment methods, including credit cards, debit cards, and electronic wallets. It can verify transactions made both online and offline.

Question 4: Is Pip Checker safe to use?

Yes, Pip Checker employs robust security measures to protect user data. The platform utilizes encryption protocols and complies with industry-leading security standards.

Question 5: What are the benefits of using Pip Checker?

Pip Checker offers numerous benefits, including increased security, reduced fraud risk, and improved transparency.

Question 6: How can I sign up for Pip Checker?

Signing up for Pip Checker is simple and convenient. Visit the official Pip Checker website and follow the registration instructions.

Pip Checker's commitment to accuracy, security, and efficiency empowers users to confidently conduct payment transactions, minimizing the risk of fraud and ensuring peace of mind.

Transition to the next article section: Benefits of Pip Checker

Tips for Enhancing Payment Security

Maintaining secure payment transactions is crucial for businesses and individuals alike. Pip Checker: Instantly Verify Your Payment Transactions can assist in safeguarding your financial well-being, consider implementing these tips to strengthen your payment security posture.

Tip 1: Verify Transactions Immediately

Promptly checking payment transactions is essential. This allows for early detection of any discrepancies, such as unauthorized charges or fraudulent activities. Pip Checker empowers users to verify transactions in real-time, providing peace of mind and timely intervention.

Tip 2: Utilize Multi-Factor Authentication

Enforce multi-factor authentication (MFA) for all financial transactions. This adds an extra layer of security by requiring additional verification beyond the traditional password. MFA can significantly reduce the risk of account compromise and unauthorized transactions.

Tip 3: Watch Out for Phishing Attempts

Phishing emails and websites are designed to deceive users into revealing sensitive information. Be cautious of emails or websites that request personal or financial information. Never click on suspicious links or download attachments from untrusted sources.

Tip 4: Use Strong Passwords

Create robust passwords that are difficult to guess. Avoid using easily recognizable words or personal details. Consider utilizing a password manager to generate and securely store complex passwords.

Tip 5: Monitor Financial Accounts Regularly

Monitor your financial accounts regularly for any unusual activity. Check for unauthorized transactions, changes to account settings, or suspicious withdrawals. Prompt action can mitigate potential losses and protect your financial assets.

Tip 6: Utilize Payment Security Tools

Leverage payment security tools such as Pip Checker to enhance transaction verification and fraud detection. These tools provide real-time alerts, transaction monitoring, and risk analysis, helping businesses and individuals stay vigilant against financial threats.

Tip 7: Maintain Software Updates

Keep software and operating systems updated regularly. Software updates often include security patches that address vulnerabilities and protect against emerging threats. Neglecting timely updates can increase your susceptibility to cyberattacks.

Tip 8: Trust Verified Payment Gateways

When making online purchases, ensure you're using reputable and secure payment gateways. Look for websites that display security certifications and have a positive reputation. Avoid making payments on websites that appear suspicious or lack proper security measures.

Remember, safeguarding your financial transactions is an ongoing process. By implementing these tips, you can significantly strengthen your payment security and protect your financial well-being.

Pip Checker: Instantly Verify Your Payment Transactions

In the digital age, ensuring the security of financial transactions has become pivotal. Pip Checker, an innovative tool, emerges as a solution. It offers a comprehensive suite of capabilities that empower users to verify payment transactions instantly, enhancing the reliability and trust in digital payments.

- Real-Time Verification

- Fraudulent Transaction Detection

- Secure Data Encryption

- Compatibility with Multiple Payment Gateways

- Cost-Effective and User-Friendly

- Integration with Accounting Systems

These aspects work in synergy to provide a robust framework for payment verification. Pip Checker's real-time capabilities enable immediate confirmation of transactions, preventing fraudulent activities. Its advanced algorithms meticulously analyze payment data, flagging suspicious transactions with precision. Furthermore, the sophisticated encryption techniques safeguard sensitive financial information, while seamless integration with multiple payment gateways ensures compatibility with various platforms. Notably, Pip Checker's cost-effectiveness and user-friendly interface make it accessible to businesses of all sizes. Its integration with accounting systems simplifies record-keeping, enhancing transparency and efficiency. By incorporating these essential aspects, Pip Checker revolutionizes payment verification, fostering a secure and trustworthy digital financial ecosystem.

Python / 解決 pip 安裝套件時遇到 SSL CERTIFICATE_VERIFY_FAILED – Charles Note - Source note.charlestw.com

Pip Checker: Instantly Verify Your Payment Transactions

Pip Checker is a revolutionary tool that enables instant verification of payment transactions, providing businesses and individuals with enhanced security and peace of mind in the digital payment landscape.

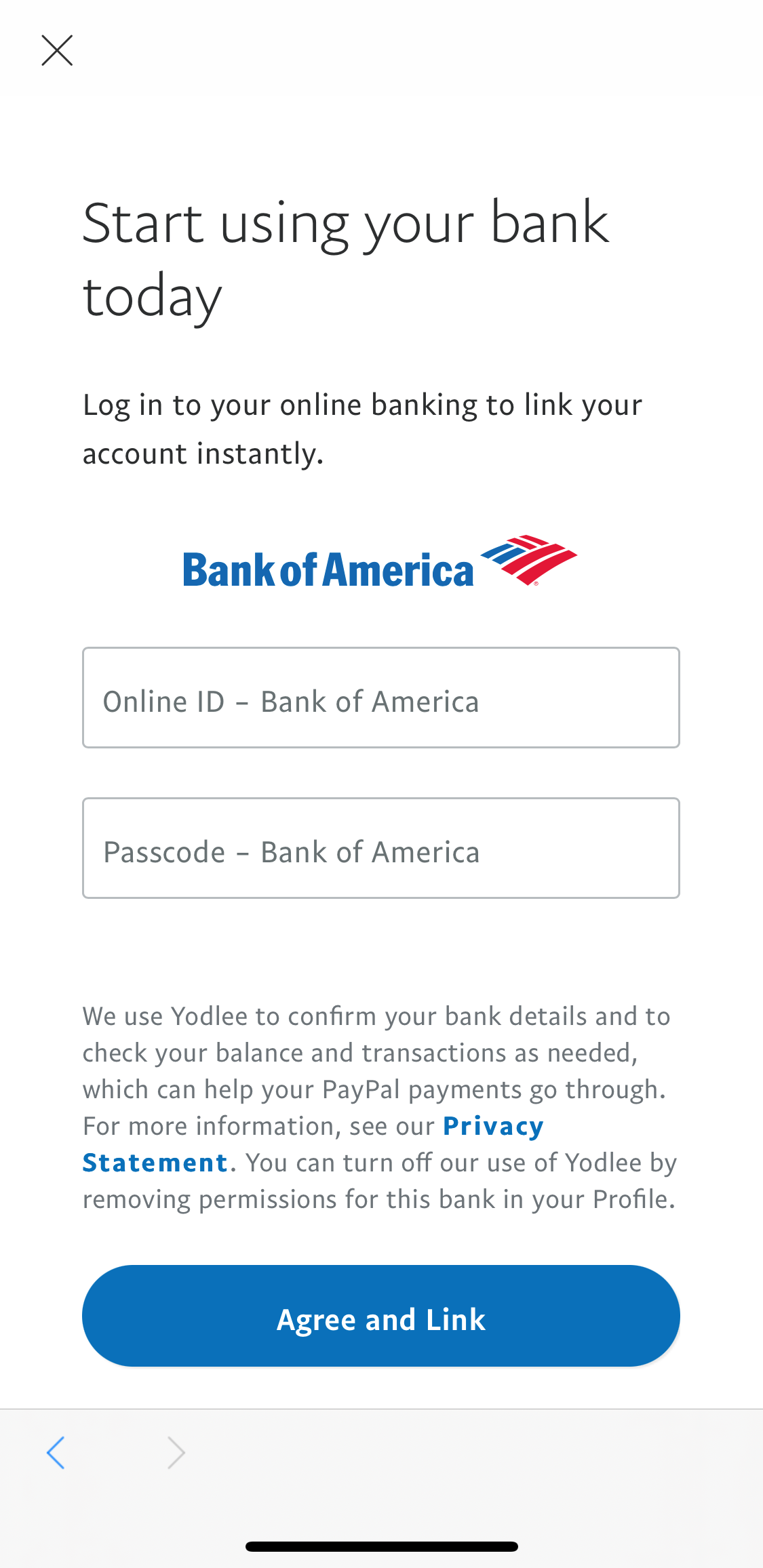

How to Verify your PayPal Account - Qmee.com - Source www.qmee.com

In today's fast-paced business environment, it is essential to have payment systems that are secure and transparent. With Pip Checker, businesses can streamline their payment processes, reduce fraud, and build trust with their customers. By leveraging the power of technology, Pip Checker empowers users to instantly validate the authenticity of payment transactions, ensuring that funds are being transferred securely and to the intended recipients.

The practical applications of Pip Checker extend beyond fraud detection. By providing businesses with real-time visibility into their payment transactions, Pip Checker can help identify potential inefficiencies and optimize cash flow management.

Conclusion

Pip Checker is a game-changer in the payment industry, offering businesses and individuals a robust solution for verifying payment transactions. Its instant verification capabilities, fraud detection prowess, and enhanced security measures make it an indispensable tool for navigating the complexities of digital payments.

By embracing Pip Checker, businesses can position themselves for success in the digital age and protect their financial interests. As the world increasingly moves towards cashless transactions, Pip Checker is poised to become an indispensable tool for those who value security, transparency, and efficiency in their payment transactions.