Preparing for retirement? Ask yourself, are you ready? The Ultimate Guide To Understanding Retirement Systems And Planning For Financial Security has all the answers you seek.

Editor's Notes: "The Ultimate Guide To Understanding Retirement Systems And Planning For Financial Security" has published today date and it’s a must-read for anyone planning for their future. Retirement planning can be daunting, but it doesn't have to be.

We did some analysis, digging information, made our way through countless articles, and put together this The Ultimate Guide To Understanding Retirement Systems And Planning For Financial Security guide to help you make the right decision.

In this guide, we'll cover everything you need to know about retirement systems, including:

| Key differences between defined benefit and defined contribution plans | Key takeaways |

| How to choose the right retirement plan for you | Tips for maximizing your retirement savings |

| Common mistakes to avoid when planning for retirement | The importance of seeking professional advice |

Whether you're just starting to think about retirement or you're already in the thick of it, this guide has something for you. So sit back, relax, and let us help you plan for a secure and comfortable retirement.

FAQ

The "Ultimate Guide to Understanding Retirement Systems and Planning for Financial Security" has been designed to answer all your questions regarding retirement planning. However, here are a few frequently asked questions for your reference.

![]()

Ultimate Guide to Security Guard Tour Systems - Source novage.ms

Question 1: What is the best way to start planning for retirement?

Answer: The best way to start planning for retirement is to assess your current financial situation and set realistic goals. Determine how much money you will need in retirement and create a savings plan that will help you reach your goals.

Question 2: How can I maximize my retirement savings?

Answer: There are several ways to maximize your retirement savings, such as contributing to a 401(k) or IRA, taking advantage of catch-up contributions if you are over 50, and considering a Roth IRA if you are in a lower tax bracket.

Question 3: What are the different types of retirement accounts?

Answer: There are several different types of retirement accounts, including traditional IRAs, Roth IRAs, 401(k)s, and 403(b)s. Each type of account has its own benefits and drawbacks, so it is important to choose the one that is right for you.

Question 4: How do I choose the right investments for my retirement portfolio?

Answer: When choosing investments for your retirement portfolio, it is important to consider your age, risk tolerance, and investment goals. A financial advisor can help you create a portfolio that meets your individual needs.

Question 5: What are the tax implications of withdrawing money from a retirement account?

Answer: The tax implications of withdrawing money from a retirement account depend on the type of account you have and your age. Withdrawals from traditional IRAs and 401(k)s are taxed as ordinary income, while withdrawals from Roth IRAs are tax-free if you have held the account for at least five years and are over 59½.

Question 6: How can I ensure that I have enough money to retire comfortably?

Answer: To ensure that you have enough money to retire comfortably, it is important to start planning early, save aggressively, and invest wisely. You should also consider working with a financial advisor to create a personalized retirement plan.

Planning for retirement can seem daunting, but it is important to remember that you are not alone. There are many resources available to help you plan for a secure financial future.

Move on to the next article section.

Tips

For a comprehensive understanding of retirement systems, planning, and financial security, consult The Ultimate Guide To Understanding Retirement Systems And Planning For Financial Security.

Tip 1: Plan Early and Consistently

Start saving for retirement as soon as possible, even if it's just small amounts. The earlier you start, the more time your money has to grow through compounding interest.

Tip 2: Utilize Retirement Accounts

Take advantage of tax-advantaged retirement accounts like 401(k)s and IRAs. These accounts allow you to save for retirement on a pre-tax basis, potentially reducing your current tax liability and allowing your investments to grow tax-free.

Tip 3: Consider Employer Contributions

If your employer offers a retirement plan with matching contributions, maximize your contributions to take full advantage of this free money.

Tip 4: Invest Wisely

Choose investments that align with your risk tolerance and time horizon. Diversify your portfolio across different asset classes (e.g., stocks, bonds, real estate) to mitigate risk.

Tip 5: Adjust Your Savings Over Time

As your income and expenses change throughout your career, adjust your retirement savings accordingly. Consider increasing your contributions or rebalancing your portfolio as needed.

Tip 6: Seek Professional Advice

Consult with a financial advisor to develop a personalized retirement plan based on your unique circumstances and financial goals.

Summary: By following these tips, you can increase your financial preparedness for retirement, ensuring a more comfortable and secure future. For further guidance, refer to The Ultimate Guide To Understanding Retirement Systems And Planning For Financial Security.

The Ultimate Guide To Understanding Retirement Systems And Planning For Financial Security

Understanding retirement systems and planning for financial security are integral components of ensuring a comfortable future after one's active working years. This guide presents six key aspects crucial for comprehending these complex topics:

- Retirement Accounts: IRAs, 401(k) plans, and other investment vehicles designed specifically for retirement savings.

- Government Programs: Social Security, Medicare, and other government-funded programs that provide income and healthcare coverage during retirement.

- Investment Strategies: Asset allocation, diversification, and risk management techniques to maximize returns and minimize losses.

- Estate Planning: Wills, trusts, and other legal instruments to ensure the distribution of one's assets in accordance with their wishes upon death.

- Tax Implications: The impact of taxes on retirement income, investments, and estate planning decisions.

- Financial Literacy: The knowledge and understanding of financial concepts necessary for making informed decisions about retirement.

These aspects are interconnected and must be considered holistically when planning for financial security in retirement. For example, understanding investment strategies can help individuals maximize returns on retirement accounts, while estate planning ensures that assets are distributed as desired after death. Financial literacy is essential for navigating the complex world of retirement systems and making informed decisions that will impact one's future well-being.

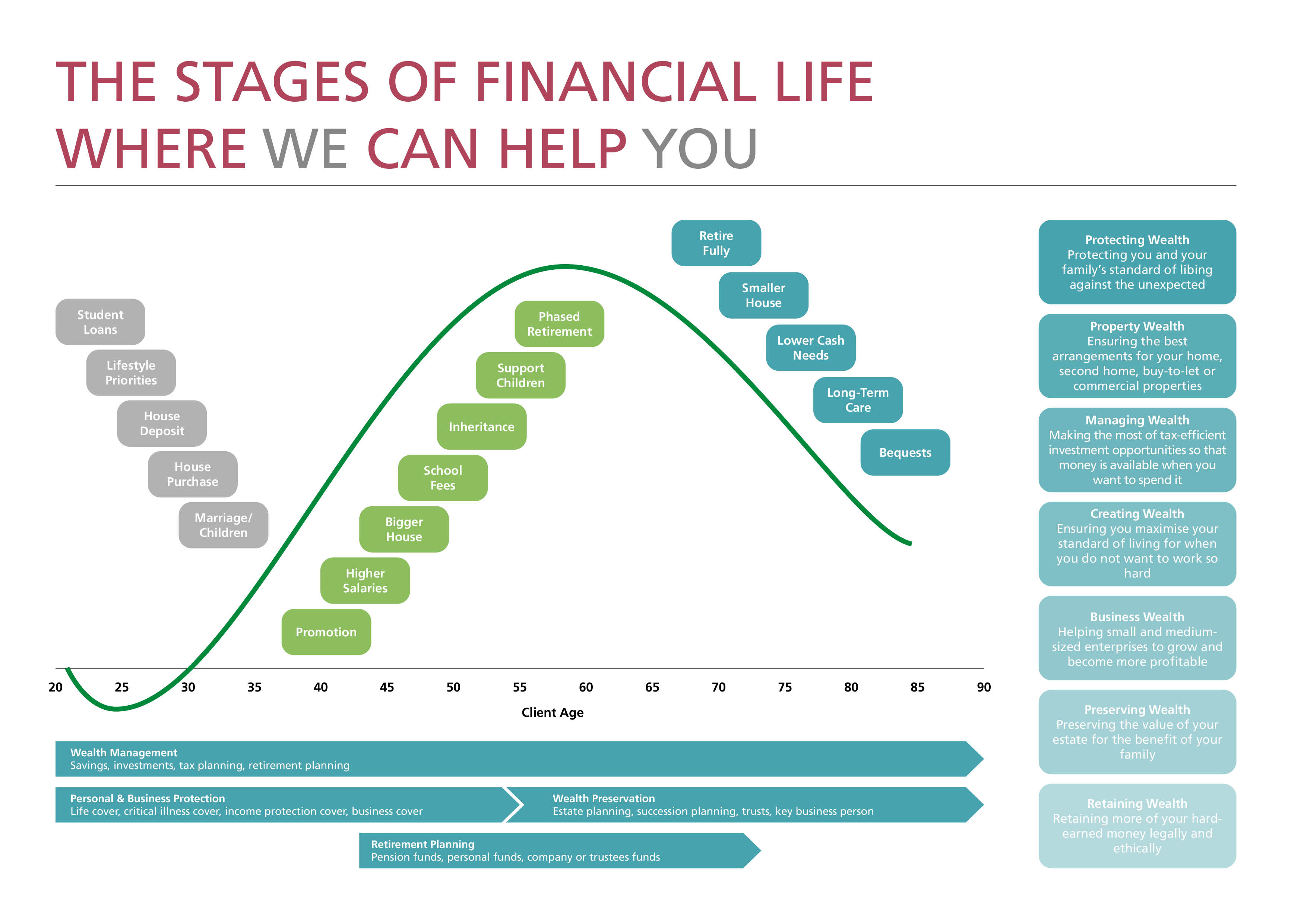

Financial Planning – Breslin Financial Services - Source www.breslinfs.co.uk

The Ultimate Guide To Understanding Retirement Systems And Planning For Financial Security

Understanding Retirement Plan Fees - Source www.multnomahgroup.com

Understanding retirement systems empowers individuals to maximize their retirement savings. By understanding the different types of retirement accounts (e.g., 401(k), IRAs), their tax implications, and contribution limits, savers can optimize their retirement plans. This knowledge enables them to create a diversified portfolio aligned with their individual financial goals and risk tolerance.

Furthermore, grasping the complexities of retirement systems enables informed decision-making regarding investment strategies. With a clear understanding of financial markets and investment options, individuals can make strategic investment decisions that align with their risk tolerance while maximizing potential returns. This understanding helps avoid costly mistakes and secure a comfortable retirement lifestyle.

The Ultimate Guide also emphasizes the significance of financial planning for retirement security. It provides practical advice on budgeting, debt management, and estate planning. By integrating financial planning with retirement system knowledge, individuals can create a comprehensive roadmap to achieve their retirement goals.

In conclusion, The Ultimate Guide To Understanding Retirement Systems and Planning For Financial Security is an invaluable resource for anyone seeking financial security in their golden years. By delving into the details of retirement systems, investment strategies, and financial planning, this guide empowers individuals to make informed decisions that will safeguard their financial well-being throughout retirement.

Conclusion

The exploration of The Ultimate Guide To Understanding Retirement Systems And Planning For Financial Security underscores the critical importance of comprehending these systems in achieving retirement security. By embracing the knowledge provided in this guide, individuals can navigate the complexities of retirement planning and make informed decisions that will ensure their financial well-being in their later years.

While navigating the complexities of retirement systems and planning can be challenging, the benefits far outweigh the efforts. By investing in this knowledge, individuals can empower themselves to secure a comfortable and financially independent retirement, ensuring their golden years are filled with financial peace of mind and the freedom to pursue their desired lifestyle.