Mopaş Hisse Senedi hakkında her şeyi öğrenmek mi istiyorsunuz? Daha fazla bilgi edinin!

Hisse senedi getiri modelleri bir kıyaslama by Salih Kurucan - Issuu - Source issuu.com

Editörün Notu: Mopaş Hisse Senedi: Kapsamlı Bir Analiz Ve Yatırım Rehberi bugün yayınlandı. Mopaş Hisse Senedi hakkında bilgi edinmek isteyenler için önemli bir kaynak.

Finansal piyasaları anlamak karmaşık bir iş olabilir. Özellikle de araştırmaya nereden başlayacağınızı bilmiyorsanız. Mopaş Hisse Senedi: Kapsamlı Bir Analiz Ve Yatırım Rehberi tam da burada devreye giriyor.

Kapsamlı analiz ve araştırma sonucunda, bu rehber size Mopaş Hisse Senedi hakkında bilmeniz gereken her şeyi sağlayacaktır. İster deneyimli bir yatırımcı olun ister sadece yatırım dünyasına adım atmaya başlayın, Mopaş Hisse Senedi: Kapsamlı Bir Analiz Ve Yatırım Rehberi hedeflerinize ulaşmanıza yardımcı olmak için ihtiyacınız olan bilgiyi sağlayacaktır.

FAQs

This FAQ section provides concise answers to frequently asked questions regarding Mopaş Hisse Senedi. Gain a comprehensive understanding of key concerns and misconceptions.

Question 1: What drives the stock price of Mopaş?

The stock price of Mopaş is influenced by various factors, including the company's financial performance, industry trends, economic conditions, and market sentiment. Strong financial results, positive industry outlook, and favorable economic conditions typically have a positive impact on the stock price.

Question 2: Is Mopaş a dividend-paying stock?

Historically, Mopaş has paid dividends to its shareholders. However, the company's dividend policy is subject to change and may vary based on its financial position and future prospects.

Question 3: What are the key risks associated with investing in Mopaş?

Investing in Mopaş carries certain risks, such as fluctuations in the company's financial performance, competition within the industry, changes in government regulations, and overall market conditions. It is crucial to conduct thorough research and assess your risk tolerance before making any investment decisions.

Question 4: How do I assess the valuation of Mopaş?

Determining the fair value of Mopaş requires a multifaceted approach. You can consider various valuation methods, such as comparing it to peer companies, analyzing its financial statements, and evaluating its future growth prospects.

Question 5: What is the outlook for Mopaş in the long term?

The long-term outlook for Mopaş depends on a combination of factors, including its ability to maintain strong financial performance, adapt to industry changes, and execute its growth strategies effectively. Analysts' consensus may provide insights into potential long-term prospects.

Question 6: Is Mopaş a suitable investment for all types of investors?

The suitability of Mopaş as an investment depends on individual investor profiles and financial goals. It may be appropriate for investors with a higher risk tolerance and a long-term investment horizon. However, it is advisable to consult with a financial advisor to determine the suitability of any investment.

This FAQ section aims to clarify common concerns and provide guidance for investors considering Mopaş. Remember to conduct thorough research, consult with financial professionals, and make informed investment decisions.

Navigate to the next article section to explore in-depth insights and analysis on Mopaş Hisse Senedi.

Tips

This guide was designed to provide investors with comprehensive insights into Mopaş Hisse Senedi. By incorporating the tips and strategies outlined below, investors can enhance their decision-making process and potentially increase their returns.

Tip 1: Conduct thorough research

Before investing in Mopaş Hisse Senedi, it is crucial to conduct thorough research on the company, its industry, and the overall market conditions. This includes examining the company's financial statements, news articles, analyst reports, and industry trends. By gathering a comprehensive understanding of the company and its operating environment, investors can make informed decisions and mitigate risks.

Tip 2: Diversify your portfolio

Diversification is a key principle of investing, and it involves spreading your investments across different asset classes and companies. By diversifying your portfolio, you can reduce the overall risk of your investment and potentially enhance your returns. Consider investing in a mix of stocks, bonds, and other assets to create a well-balanced portfolio.

Tip 3: Set realistic investment goals

Before investing, it is essential to establish realistic investment goals. Consider your financial situation, investment horizon, and risk tolerance. Setting realistic goals will help you make informed investment decisions and avoid emotional decision-making. Remember that investing is a long-term game, and patience is key.

Tip 4: Monitor your investments regularly

Once you have invested in Mopaş Hisse Senedi, it is important to monitor your investments regularly. This involves tracking the company's performance, market conditions, and any relevant news or events. Regular monitoring allows you to make adjustments to your investment strategy as needed and react to changes in the market.

Tip 5: Consider the company's long-term prospects

When investing in Mopaş Hisse Senedi, it is essential to consider the company's long-term prospects. Evaluate the company's competitive advantages, industry outlook, and management team. By focusing on the long-term potential of the company, you can increase your chances of achieving positive returns over time.

These tips are designed to guide investors and help them make informed decisions when it comes to investing in Mopaş Hisse Senedi. Remember that investing involves risk, and it is essential to conduct thorough research and consult with a financial advisor if necessary. By following these tips and strategies, investors can potentially enhance their returns and achieve their financial goals.

For a more comprehensive analysis of Mopaş Hisse Senedi, refer to Mopaş Hisse Senedi: Kapsamlı Bir Analiz Ve Yatırım Rehberi, which provides in-depth insights into the company's financial performance, industry dynamics, and investment potential.

Mopaş Hisse Senedi: Kapsamlı Bir Analiz Ve Yatırım Rehberi

A meticulous examination of Mopaş Hisse Senedi requires a multifaceted investigation encompassing its intrinsic qualities, market dynamics, and potential investment strategies.

- Finansal Performans: Evaluating profitability, revenue growth, and debt-to-equity ratio.

- Sektorel Dinamikler: Assessing industry trends, competitive landscape, and regulatory factors.

- Yönetim: Scrutinizing the competence and experience of the company's leadership.

- Değerleme: Determining fair value through various methodologies such as discounted cash flow analysis.

- Teknik Analiz: Employing chart patterns and technical indicators to identify potential trading opportunities.

- Risk Yönetimi: Assessing volatility, market risks, and implementing strategies for risk mitigation.

These key aspects offer a comprehensive framework for analyzing Mopaş Hisse Senedi. By evaluating financial performance, industry dynamics, management quality, valuation, technical indicators, and risk management strategies, investors can make informed decisions regarding the potential investment opportunities and risks associated with the stock.

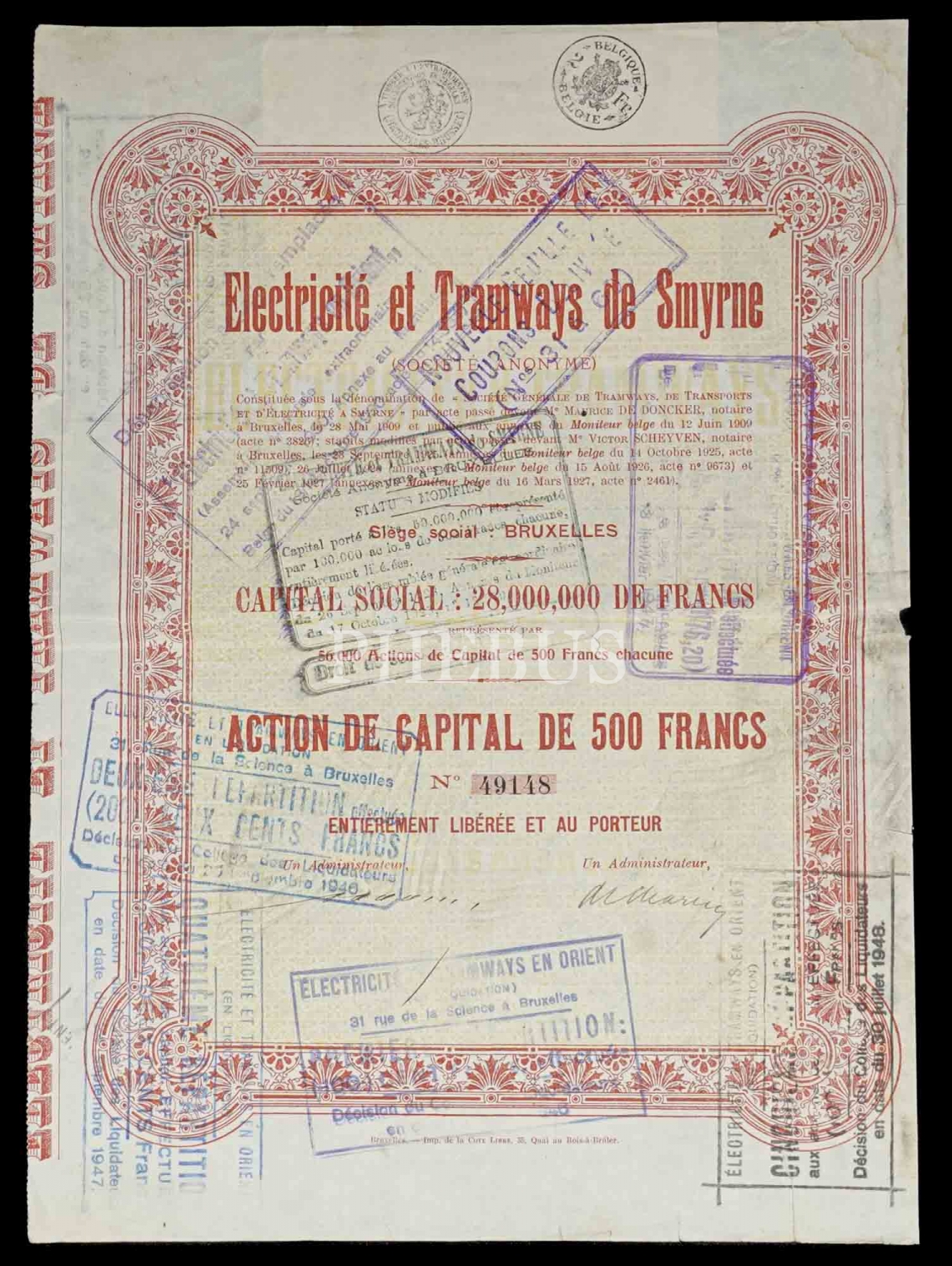

İzmir Tramvay ve Elektrik Anonim Şirketi, 1927 tarihli bir aksiyon - Source phebusmuzayede.com

Mopaş Hisse Senedi: Kapsamlı Bir Analiz Ve Yatırım Rehberi

"Mopaş Hisse Senedi: Kapsamlı Bir Analiz Ve Yatırım Rehberi", potansiyel yatırımcılar için Mopaş hisse senedinin derinlemesine bir incelemesini sunar. Rehber, şirketin finansal performansını, sektör dinamiklerini ve büyüme potansiyelini kapsamlı bir şekilde analiz etmektedir.

Hisse Senedi-İstanbul Tramvay ve Elektrik A.Ş, 1914 Tarihli Bir Paylık - Source www.janusmezat.com

Bu rehber, yatırımcıların Mopaş hisse senedine yatırım yapıp yapmama konusunda bilinçli kararlar vermelerine yardımcı olacak değerli bilgiler içerir. Şirketin mali sağlığı, rekabet avantajı ve gelecekteki beklentileri hakkında fikir vererek, yatırımcılara yatırımlarını yönlendirme konusunda güven verir.

Sonuç olarak, "Mopaş Hisse Senedi: Kapsamlı Bir Analiz Ve Yatırım Rehberi", yatırımcıların potansiyel yatırımları hakkında bilinçli kararlar vermelerine yardımcı olan kapsamlı ve değerli bir kaynaktır.

Önemli Notlar:

Bu rehber, yatırım tavsiyesi değildir. Hisse senedi piyasası riskli olabilir ve yatırımcılar yatırım yapmadan önce kendi araştırmalarını yapmalıdırlar. Herhangi bir yatırım kararı vermeden önce finansal bir profesyonele danışılması önerilir.