Kayyum: The Ultimate Guide To Insolvency Resolution And Corporate Revival is a comprehensive guide to the insolvency resolution process in India. It provides a detailed overview of the legal framework, the role of the insolvency professional, and the various options available to creditors and debtors.

Editor's Notes: Kayyum: The Ultimate Guide To Insolvency Resolution And Corporate Revival have published today date. This topic is important to read because it provides a clear and concise explanation of the insolvency resolution process, which can be a complex and confusing topic.

We have done some analysis, digging information, made Kayyum: The Ultimate Guide To Insolvency Resolution And Corporate Revival we put together this Kayyum: The Ultimate Guide To Insolvency Resolution And Corporate Revival guide to help target audience make the right decision.

Key differences or Key takeways:

| Kayyum: The Ultimate Guide To Insolvency Resolution And Corporate Revival | |

|---|---|

| Author | Insolvency and Bankruptcy Board of India |

| Publication Date | 2019 |

| ISBN | 978-93-5379-169-6 |

| Pages | 352 |

Main article topics:

- The Insolvency and Bankruptcy Code, 2016

- The role of the insolvency professional

- The various options available to creditors and debtors

- The insolvency resolution process

- Corporate revival

FAQ

This comprehensive FAQ section addresses common concerns and misconceptions regarding insolvency resolution and corporate revival, providing clear and informative answers to guide readers through complex legal and financial processes.

A Guide to Handling Sensitive Information in the American Corporate - Source www.alphabpo.co.za

Question 1: What is the purpose of insolvency resolution?

Insolvency resolution aims to rescue financially distressed companies, preserving their value and maximizing returns for creditors. It offers a structured process for assessing the company's viability, formulating a revival plan, and implementing measures to facilitate its recovery.

Question 2: What are the key steps in the insolvency resolution process?

The insolvency resolution process typically involves the appointment of a resolution professional, assessment of the company's financial health, development of a resolution plan, and its approval by creditors and other stakeholders.

Question 3: What is the role of the resolution professional?

The resolution professional serves as an independent expert appointed by the National Company Law Tribunal (NCLT). They manage the insolvency resolution process, assess the company's viability, and facilitate the development and implementation of the resolution plan.

Question 4: What is the difference between liquidation and resolution?

Liquidation involves winding down a company's operations and distributing its assets to creditors. Resolution, on the other hand, focuses on preserving the company as a going concern by restructuring its debt and implementing a recovery plan.

Question 5: What are the benefits of successful insolvency resolution?

Successful insolvency resolution can prevent the company's liquidation, preserve jobs, protect creditor interests, and contribute to the overall stability of the economy.

Question 6: What are some common misconceptions about insolvency resolution?

One common misconception is that insolvency resolution is a negative process that leads to business failure. However, it is a legal framework designed to provide a second chance for financially distressed companies to recover and continue operating.

In summary, insolvency resolution is a crucial process that offers a structured approach to corporate revival, promoting the preservation of businesses, the protection of creditor interests, and the enhancement of economic stability.

Moving on to the next section of the article...

Tips

This section presents practical tips for effective insolvency resolution and corporate revival. Drawing insights from Kayyum: The Ultimate Guide To Insolvency Resolution And Corporate Revival, these tips offer invaluable guidance for professionals navigating the complexities of corporate distress.

Tip 1: Prioritize Timely Intervention

Early detection and intervention are crucial in insolvency resolution. Recognizing early warning signs, such as financial distress or operational challenges, allows for proactive measures to address the underlying issues before the situation worsens. Prompt intervention enhances the chances of successful restructuring or revival.

Tip 2: Conduct Thorough Due Diligence

A comprehensive due diligence process is essential to assess the financial health, legal standing, and operational capabilities of the distressed company. This process involves examining financial statements, contracts, and other relevant documents to gain a clear understanding of the situation. Thorough due diligence enables informed decision-making and promotes transparency throughout the resolution process.

Tip 3: Consider Restructuring Options

Restructuring can be an effective strategy for preserving the value of the distressed company and maximizing recoveries for creditors. It involves altering the company's financial structure, operations, or ownership to resolve financial challenges. There are various restructuring options available, and selecting the most appropriate one requires careful consideration of the company's circumstances and objectives.

Tip 4: Facilitate Stakeholder Engagement

Effective insolvency resolution requires the cooperation and consensus of stakeholders, including creditors, shareholders, management, and employees. Open and transparent communication with all stakeholders is vital to build trust, manage expectations, and gain support for the chosen resolution plan. Regular updates and information sharing foster stakeholder engagement and minimize conflict.

Tip 5: Seek Professional Assistance

Dealing with corporate distress and insolvency is a complex process. Seeking professional assistance from experienced insolvency practitioners, legal counsel, and financial advisors is highly advisable. These professionals provide expert guidance, support, and representation throughout the resolution process, ensuring compliance with legal and regulatory requirements and maximizing the likelihood of a successful outcome.

By following these tips, organizations can approach insolvency resolution and corporate revival with a more informed and proactive mindset, improving their chances of achieving positive outcomes and preserving the value of their businesses.

Kayyum: The Ultimate Guide To Insolvency Resolution And Corporate Revival

Insolvency resolution and corporate revival hinge upon the role of Kayyum—a judicial administrator. This guide unveils crucial aspects of Kayyum's mandate, nurturing a deeper understanding of this multifaceted concept.

- Statutory Powers: Kayyum wields legal authority to oversee insolvency proceedings.

- Creditor Protection: Safeguarding stakeholder interests by ensuring fair distribution of assets.

- Business Rehabilitation: Focused on preserving viable businesses and preventing liquidation.

- Transparency and Accountability: Maintaining clarity and openness throughout insolvency proceedings.

- Compliance and Enforcement: Implementing resolution plans and enforcing applicable laws and regulations.

- Collaboration with Stakeholders: Facilitating dialogue and consensus among affected parties.

Kayyum's multifaceted role encompasses statutory powers, stakeholder protection, business rehabilitation, transparency, compliance, and stakeholder engagement. These elements form the cornerstone of effective insolvency resolution and corporate revival processes, ensuring a fair, efficient, and transparent outcome.

NCLT: Foreign entity can file plea for initiation of Corporate - Source www.ascgroup.in

Kayyum: The Ultimate Guide To Insolvency Resolution And Corporate Revival

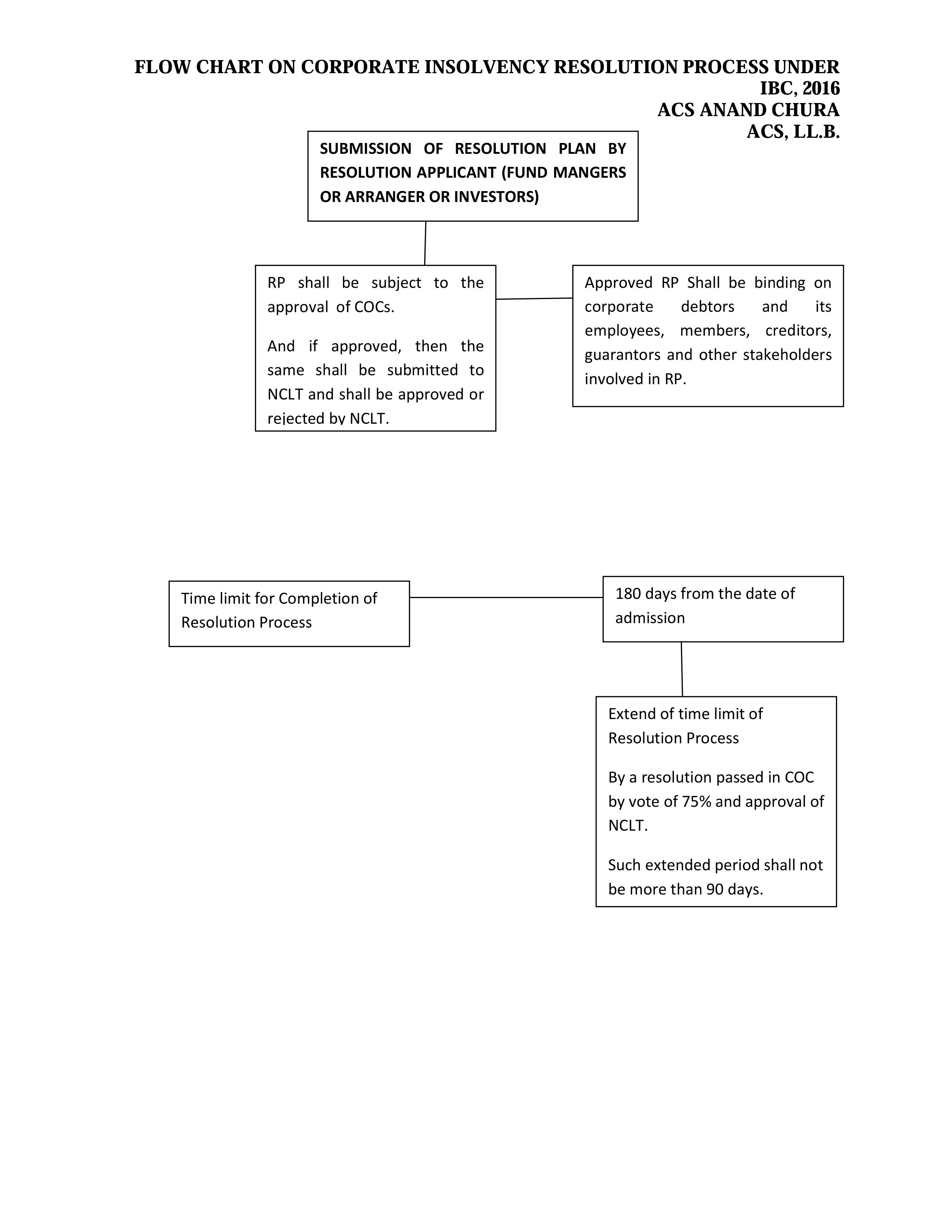

Flow Chart of Corporate Insolvency Resolution Process (CIRP) under - Source blogs.compliancecalendar.in

"Kayyum: The Ultimate Guide To Insolvency Resolution And Corporate Revival" offers an in-depth understanding of the insolvency resolution process and the role of the Kayyum, a court-appointed insolvency professional, in facilitating the revival of distressed companies. This guide provides a comprehensive analysis of the legal and practical aspects of insolvency resolution, including the appointment and powers of the Kayyum, the assessment of the company's financial health, the development of resolution plans, and the implementation of restructuring strategies.

The book explores the importance of a timely and efficient insolvency resolution process in minimizing economic losses and preserving the value of distressed companies. Real-life case studies illustrate the practical application of insolvency resolution principles and highlight the challenges faced by companies undergoing restructuring. By providing a detailed overview of the insolvency resolution framework, "Kayyum: The Ultimate Guide To Insolvency Resolution And Corporate Revival" serves as a valuable resource for insolvency professionals, corporate managers, legal practitioners, and anyone seeking to understand the complexities of corporate distress and recovery.

This guide emphasizes the need for a collaborative approach involving all stakeholders, including creditors, shareholders, and employees, to ensure a successful insolvency resolution outcome. It also highlights the ethical and professional responsibilities of the Kayyum in balancing the interests of different parties and ensuring transparency and fairness throughout the process.

Table: Key Insights

| Aspect | Key Insight |

|---|---|

| Importance of Timely Resolution | Early intervention and timely initiation of insolvency proceedings can increase the chances of successful corporate revival. |

| Role of the Kayyum | The Kayyum plays a pivotal role in assessing the company's financial health, developing resolution plans, and overseeing the restructuring process. |

| Stakeholder Collaboration | Effective communication and cooperation among creditors, shareholders, and employees are essential for a successful resolution. |