Council Tax Hikes: Understanding The Impact On Your Budget

Editor's Notes: Council Tax Hikes: Understanding The Impact On Your Budget has been published today. This article will help give you a clear overview of Council Tax Hikes: Understanding The Impact On Your Budget and provides crucial information that can help you make informed decisions about your finances.

We understand that Council Tax Hikes: Understanding The Impact On Your Budget can be a complex and confusing topic. That's why we've done the work for you, analyzing the data and gathering the information you need to make informed decisions about your finances.

In this guide, we'll cover everything you need to know about Council Tax Hikes: Understanding The Impact On Your Budget, including:

- What is Council Tax?

- Why are Council Tax rates increasing?

- How will Council Tax hikes impact your budget?

- What can you do to reduce the impact of Council Tax hikes?

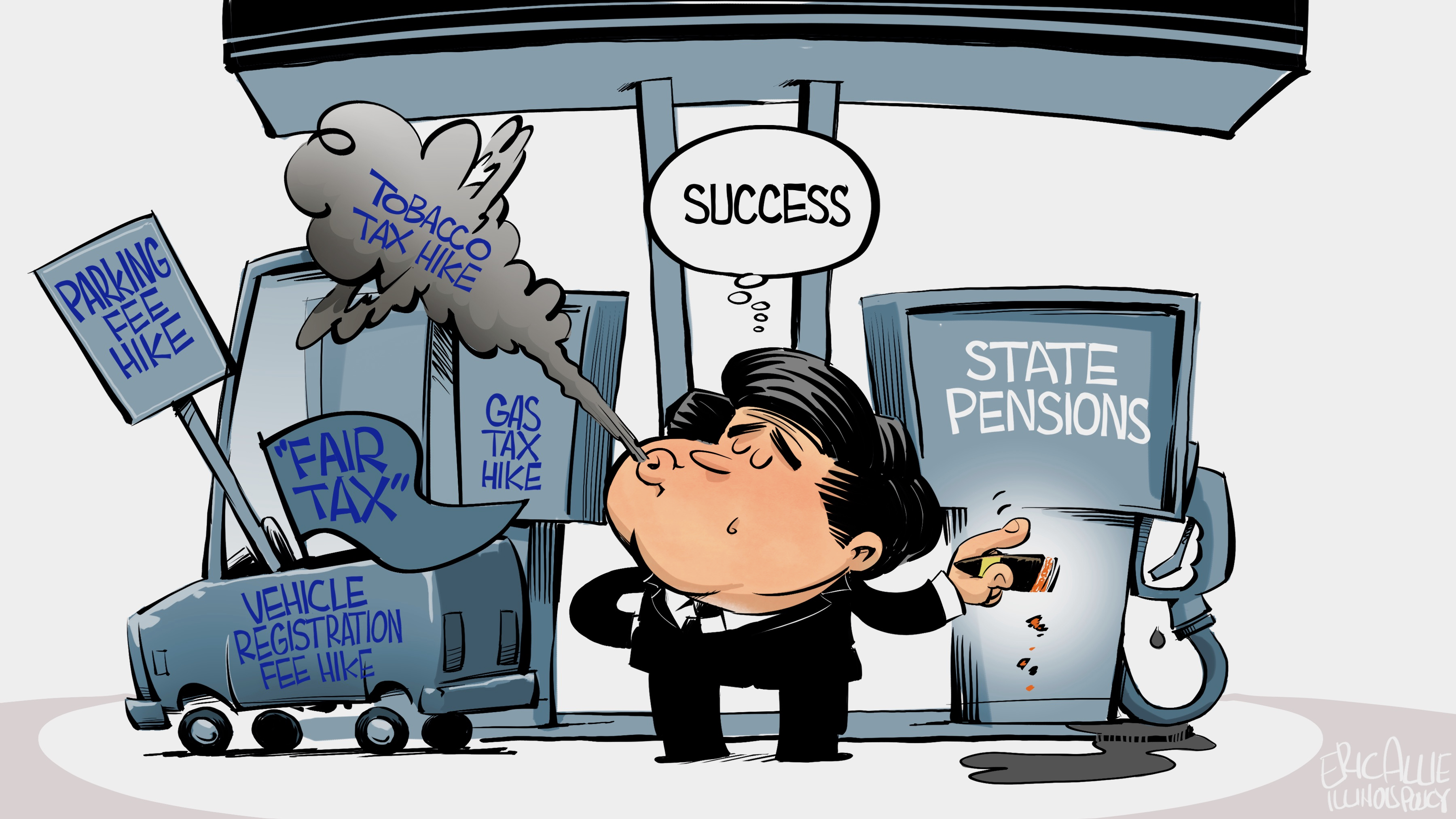

Pritzker’s tax hikes: blowing smoke | Illinois Policy - Source www.illinoispolicy.org

By the end of this guide, you'll have a clear understanding of Council Tax Hikes: Understanding The Impact On Your Budget and the steps you can take to minimize their impact on your finances.

Don't wait, read on to learn more about Council Tax Hikes: Understanding The Impact On Your Budget today!

FAQ

This FAQ section provides detailed answers to frequently asked questions regarding the implications of council tax increases on personal finances. It aims to clarify common misconceptions and equip readers with a comprehensive understanding of the potential impact on their budgets.

Question 1: What are the primary reasons behind council tax hikes?

Council tax increases typically stem from a combination of factors. These may include rising costs of local services, such as social care, education, and waste management. Additionally, government funding cuts or limitations can necessitate tax increases to maintain essential services.

Question 2: How can council tax hikes affect my budget?

Council tax increases can have a significant impact on household finances. They lead to higher monthly outgoings, which can strain budgets and limit spending in other areas. Those on low incomes or with limited financial resources may find council tax hikes particularly challenging.

Question 3: Are there any exemptions or discounts available for council tax?

Certain individuals and households may qualify for exemptions or discounts on their council tax. These typically include those on low incomes, students, and individuals with disabilities. It is important to check with the local council for eligibility criteria and application processes.

Question 4: What options are available to minimize the impact of council tax hikes?

There are several strategies to mitigate the impact of council tax increases. These include exploring payment plans, seeking financial assistance programs, and reviewing eligibility for exemptions or discounts. Additionally, it may be beneficial to evaluate household expenses and identify potential areas for savings.

Question 5: How can I keep informed about future council tax changes?

Staying informed about potential council tax changes is crucial for effective financial planning. Local council websites, newspapers, and community notice boards often provide updates on upcoming changes. Additionally, contacting the local council directly can provide valuable information.

Question 6: What should I do if I am struggling to pay my council tax?

If encountering difficulties in paying council tax, it is essential to contact the local council promptly. They can provide information on available support programs, payment plans, and potential exemptions. Ignoring council tax bills can result in legal action and further financial penalties.

Understanding the implications of council tax hikes is crucial for managing personal finances effectively. By addressing common concerns and providing practical advice, this FAQ section aims to empower individuals with the knowledge and resources to navigate this often-complex issue.

For further insights and guidance, please explore the following sections:

Tips

Council tax increases can significantly impact your budget. Here are several strategies to help you understand and manage the financial implications:

Tip 1: Check your council tax band

Confirm that your property is in the correct council tax band. An incorrect classification could lead to overpaying. Visit the Valuation Office Agency website to verify your band.

Tip 2: Apply for a council tax reduction

If you have a low income or receive certain benefits, you may qualify for a council tax reduction. Contact your local council to find out if you are eligible.

Tip 3: Consider a payment plan

If you are struggling to make your council tax payments, you can request a payment plan. This allows you to spread the cost over a longer period, making it more manageable.

Tip 4: Explore additional support options

Some charities and organizations offer financial assistance to individuals who are struggling to pay their council tax. Contact your local Citizen's Advice Bureau or search online for support programs.

Tip 5: Make use of online resources

Council Tax Hikes: Understanding The Impact On Your Budget provides comprehensive information on council tax increases. It offers tips, case studies, and expert advice to help you navigate the financial implications.

Council Tax Hikes: Understanding The Impact On Your Budget

Significant increases in Council Tax can profoundly impact personal finances. It is imperative to comprehend the multifaceted repercussions it may have on budgets.

- Increased Expenditure: Higher taxes lead to increased outgoings, straining budgets and potentially limiting disposable income.

- Reduced Savings: With less disposable income, individuals may have to cut back on savings, hindering financial goals.

- Tougher Financial Decisions: Council tax hikes necessitate tougher financial decisions, potentially leading to trade-offs between essential expenses.

- Impact on Debt: Reduced disposable income can make it more challenging to repay debts, potentially leading to financial difficulties.

- Property Value Implications: High Council Tax could potentially impact property values, affecting homeowners' equity and potentially making it harder to sell.

- Governmental Accountability: Understanding the impact of tax hikes on citizens holds the government accountable for responsible fiscal decision-making.

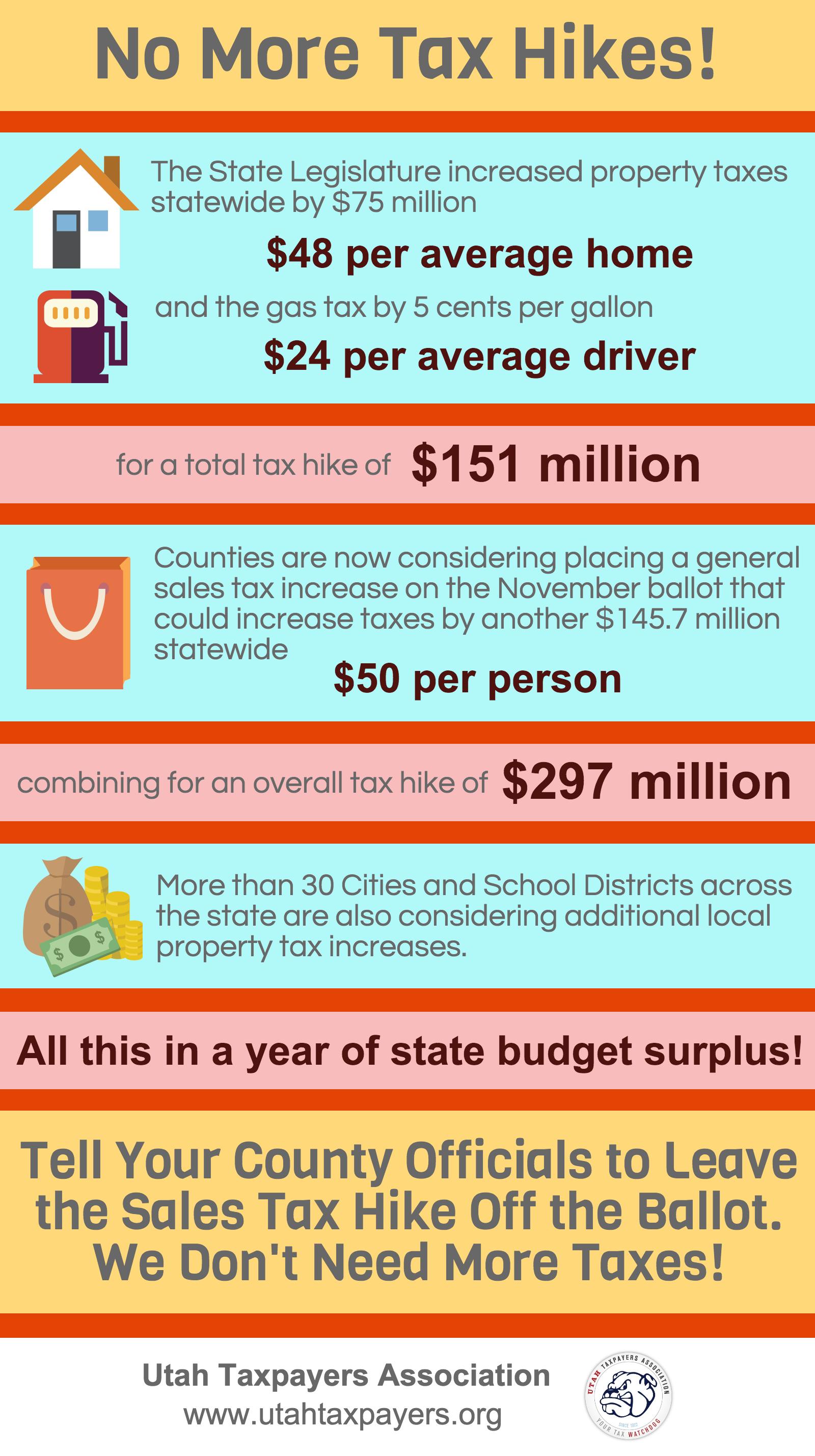

No More Tax Hikes! | Utah Taxpayers - Source utahtaxpayers.org

These aspects collectively highlight the significant impact that Council Tax hikes can have on household finances. Individuals need to carefully consider the potential consequences and plan accordingly to mitigate the negative effects and maintain financial stability. Furthermore, sustained pressure on the government for responsible tax policies is crucial to safeguard citizens' financial well-being.

Council to vote on Chow's tax hikes as Bradford calls for a tax break - Source torontosun.com

Council Tax Hikes: Understanding The Impact On Your Budget

Council tax hikes are a significant issue for many households, as they can have a substantial impact on their budget. The amount of council tax that you pay is determined by a number of factors, including the value of your property, the area in which you live, and the services that your local council provides.

Understanding the Four Phases of Your Retirement Budget Strategy - Source southparkcapital.com

In recent years, council tax hikes have become increasingly common. This is due to a number of factors, including the rising cost of providing local services and the government's austerity measures. Council tax hikes can have a significant impact on household budgets, and can make it difficult for people to make ends meet.

There are a number of things that you can do to reduce the impact of council tax hikes on your budget. These include:

- Applying for a council tax reduction

- Claiming benefits

- Reducing your spending

- Finding a more affordable home

Conclusion

Council tax hikes are a significant issue for many households, and can have a substantial impact on their budget. There are a number of things that you can do to reduce the impact of council tax hikes on your budget, but it is important to remember that council tax is a necessary expense that helps to fund local services.

If you are struggling to pay your council tax, it is important to seek help from your local council. They may be able to offer you a payment plan or a reduction in your bill.