Unlock Your State Pension Future: Maximizing Your Retirement Benefits is a comprehensive guide that helps individuals plan and maximize their state pension benefits. It provides valuable insights into the state pension system, eligibility criteria, and strategies to enhance retirement income.

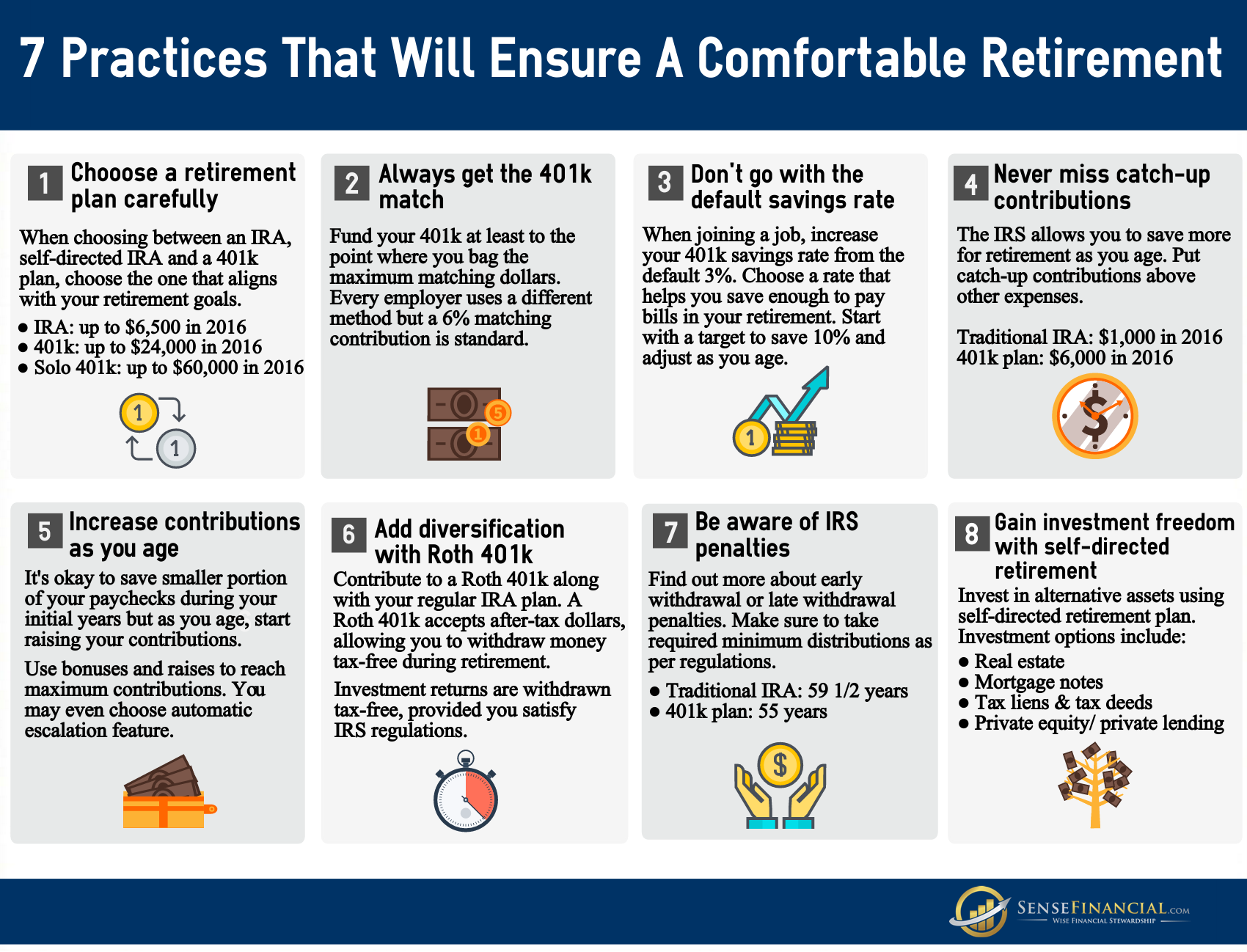

Infographic: 8 Retirement tips that will ensure a comfortable retirement - Source www.sensefinancial.com

Through extensive analysis and research, we have compiled this guide to assist individuals in making informed decisions about their state pension. The guide covers various key differences and takeaways presented in an easy-to-understand table format.

The main article topics include eligibility requirements, types of state pensions, maximizing pension contributions, and planning for retirement. It also includes case studies and examples to illustrate the concepts and strategies discussed in the guide.

FAQ: Unlock Your State Pension Future

Our comprehensive guide provides valuable information on maximizing state pension benefits. The following FAQs address some frequently asked questions:

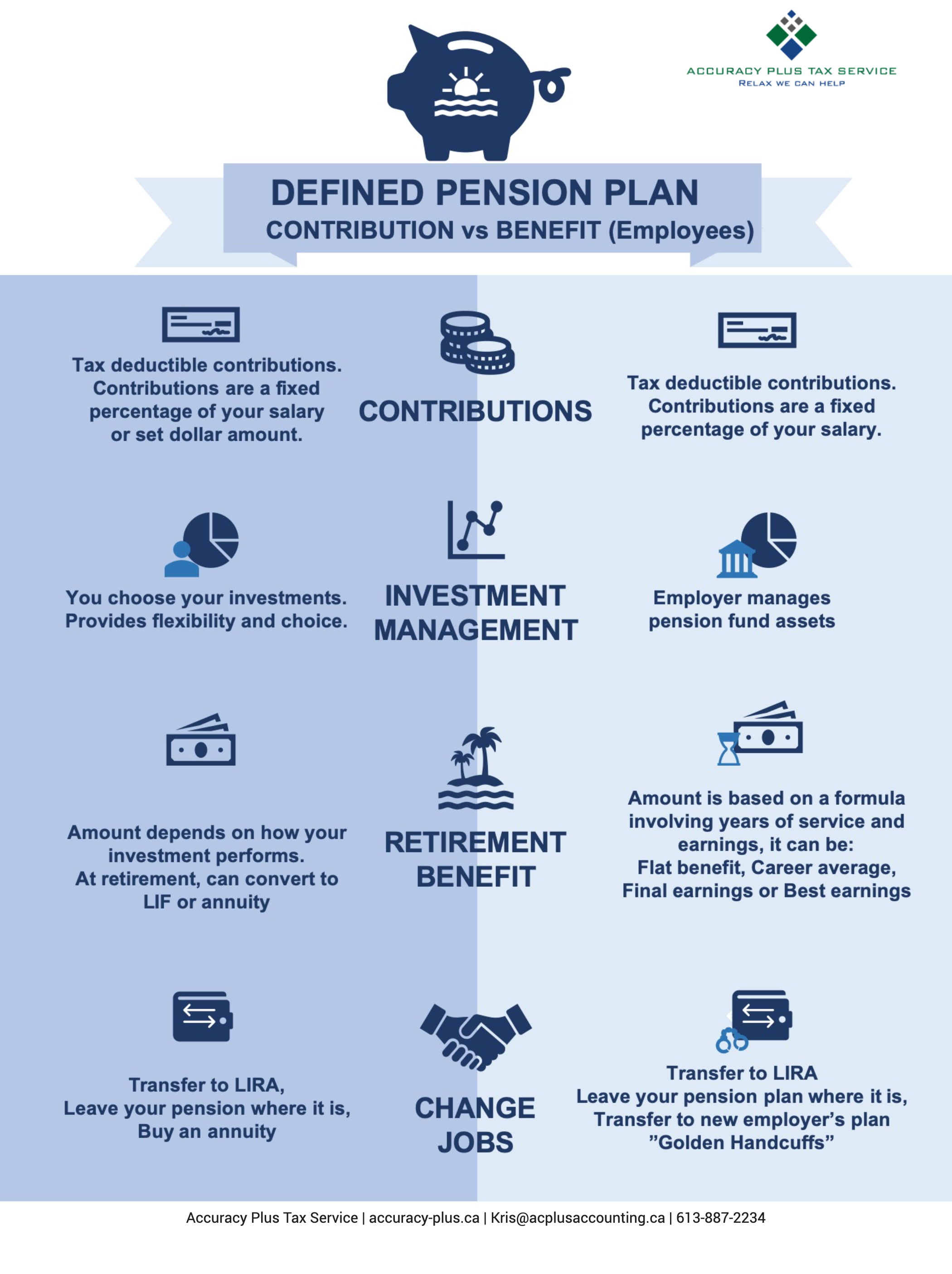

Retirement plan services | Early Retirement - Source earlyretirement.netlify.app

Question 1: What is the state pension age?

The state pension age varies depending on your date of birth. You can check your state pension age on the government website.

Question 2: How much will I receive in state pension?

The amount you receive depends on your National Insurance (NI) contributions.

Question 3: Can I increase my state pension?

To maximize your pension, ensure you have sufficient NI contributions, consider voluntary contributions, and defer receiving your pension.

Question 4: What if I have gaps in my NI record?

You may be able to fill gaps by paying voluntary NI contributions.

Question 5: Can I work and receive my state pension?

Yes, you can work and receive your state pension. Your income may affect the amount you receive.

Question 6: What happens if I die before I receive my state pension?

Your spouse or civil partner may be entitled to a bereavement payment.

Remember, planning and preparation are key to securing a comfortable retirement. Explore your options thoroughly to maximize your state pension and ensure a secure financial future.

Check out our guide for more detailed information and expert advice.

Tips

To unlock your state pension future and maximize your retirement benefits, consider implementing these strategies:

Tip 1: Understand Your State Pension Structure

Familiarize yourself with the specific rules and eligibility criteria of your state's pension system. Determine the required years of service, age of retirement, and benefit calculation formula.

Tip 2: Optimize Your Contributions

Maximize your contributions to your state pension plan, especially if your employer offers matching contributions. Consider increasing your contributions gradually over time to build your savings without a significant impact on your current budget.

Tip 3: Take Advantage of Catch-Up Provisions

If you have missed out on contributing to your state pension in the past, explore catch-up provisions that allow you to make additional contributions at a later stage. These provisions can help you make up for lost time and increase your future benefits.

Tip 4: Consider Retirement Savings Alternatives

In addition to your state pension, consider diversifying your retirement savings by exploring options such as 401(k) plans, IRAs, or personal investments. These savings vehicles can supplement your state pension and provide additional financial security in retirement.

Tip 5: Delay Retirement if Possible

Retiring later, even by a few years, can significantly increase your state pension benefits. This is because you accumulate more years of service, and your benefits are calculated based on your highest-earning years.

For more in-depth guidance on maximizing your state pension benefits, refer to the comprehensive article Unlock Your State Pension Future: Maximizing Your Retirement Benefits.

Unlock Your State Pension Future: Maximizing Your Retirement Benefits

Maximizing your state pension requires understanding and strategizing around key aspects such as eligibility, contributions, scheme options, benefit calculation, tax implications, and financial planning.

- Eligibility

- Contributions

- Scheme Options

- Benefit Calculation

- Tax Implications

- Financial Planning

Eligibility depends on nationality, residency, and National Insurance contributions. Maximizing contributions involves understanding contribution rates, voluntary contributions, and employer matching. Scheme options include the Basic State Pension, Additional State Pension, and State Second Pension. Benefit calculation considers factors like earnings history, contribution years, and age. Tax implications relate to thresholds, allowances, and potential tax charges on pension income. Financial planning involves budgeting, investment strategies, and integrating pension income into overall retirement goals.

Unlock Your State Pension Future: Maximizing Your Retirement Benefits

The state pension is a vital part of the UK retirement system, providing a foundation for financial security in later life. Understanding how to maximize your state pension entitlement is crucial for ensuring a comfortable retirement. This article explores the connection between "Unlock Your State Pension Future: Maximizing Your Retirement Benefits" and its importance as a component of the overall goal of securing a financially secure retirement.

Social Security and Pension Overpayments: How To Protect Your - Source time.news

The state pension is calculated based on the number of years of National Insurance contributions made. By working and paying National Insurance, individuals build up entitlement to a basic state pension. Additional state pension can be earned through voluntary contributions or by opting out of the state second pension. Maximizing your state pension entitlement means ensuring you have a sufficient number of qualifying years and maximizing your contributions.

The practical significance of understanding the connection between "Unlock Your State Pension Future: Maximizing Your Retirement Benefits" lies in the potential financial benefits it can bring. By optimizing your state pension entitlement, you can increase your retirement income and reduce the risk of financial hardship in later life. This understanding can also help you make informed decisions about your retirement planning, such as when to retire and how much additional savings you may need.

| Factor | Impact on State Pension Entitlement |

|---|---|

| Number of qualifying years | Determines the basic state pension amount |

| Level of National Insurance contributions | Affects the amount of additional state pension earned |

| Voluntary contributions | Can boost state pension entitlement |