Worried about rising bills, getting a new job, or changes in circumstances? "Universal Credit: Essential Guide To Understanding And Claiming Benefits" is here to help.

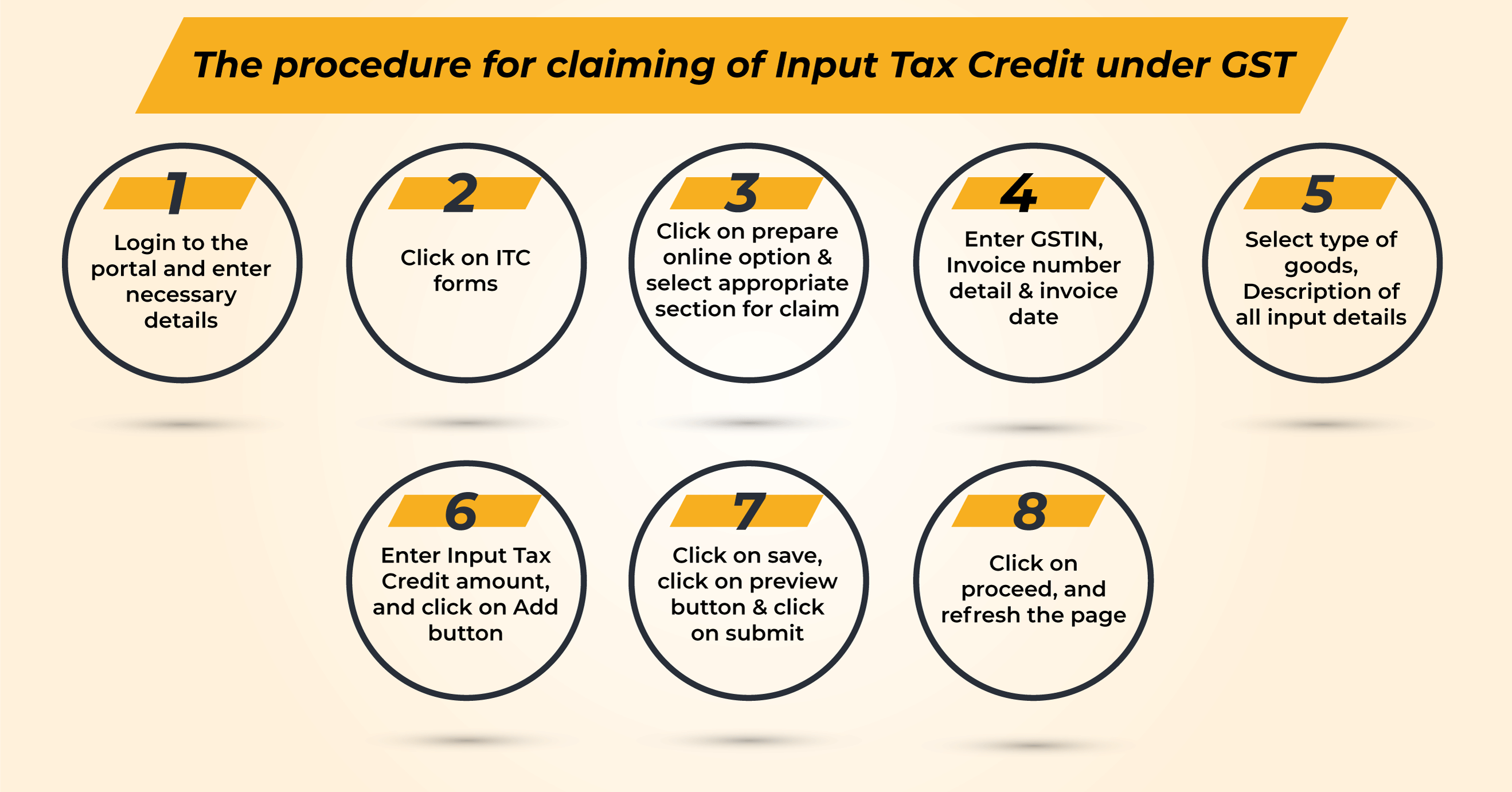

All about Input Tax Credit under GST - Source www.caclubindia.com

Editor's Note: "Universal Credit: Essential Guide To Understanding And Claiming Benefits" has been published today due to the very high interest in Universal Credit. If you are interested in knowing more about Universal Credits in UK, please continue reading our guide below.

After analyzing and digging through the information available, we have put together this guide to help you make the right decision.

FAQ

This document provides a comprehensive overview of Universal Credit, its eligibility criteria, and the application process.

Universal Themes Throughout the Year - Envision Gifted - Source envisiongifted.com

Question 1: What is Universal Credit?

Universal Credit is a payment from the government that combines several benefits into one monthly payment. It includes elements such as housing benefit, jobseeker's allowance, and income support.

Question 2: Who is eligible for Universal Credit?

To be eligible, you must be of working age (18 to state pension age), have a low income or no income, and have less than £16,000 in savings.

Question 3: How do I apply for Universal Credit?

You can apply online through the government website or by calling the Universal Credit helpline. The application process may take several weeks or even months.

Question 4: What are the different types of Universal Credit?

There are two main types: standard Universal Credit and advance Universal Credit. Advance Universal Credit is a loan that is paid back through your regular Universal Credit payments.

Question 5: How much Universal Credit will I get?

The amount of Universal Credit you receive depends on your individual circumstances, including your income, housing costs, and number of children.

Question 6: What are the payment dates for Universal Credit?

Universal Credit is usually paid on the same date each month. The payment date is determined when you first apply.

Understanding Universal Credit can be complex, but it is important to be aware of the key aspects to ensure you can access the support you are entitled to.

Tips

Make the most of Universal Credit by following these tips.

Tip 1: Understand eligibility criteria

Check if you meet the requirements for claiming Universal Credit, such as age, residency, and income.

Tip 2: Gather necessary documents

Have proof of identity, address, and income ready to support your claim.

Tip 3: Apply online or by phone

Choose the most convenient method for you. Universal Credit: Essential Guide To Understanding And Claiming Benefits provides detailed instructions for both options.

Tip 4: Keep track of appointments

Attend all scheduled appointments with the Jobcentre or Work Coach to avoid delays in your claim.

Tip 5: Report changes promptly

Inform Universal Credit of any changes in your circumstances, such as income, address, or family situation.

Tip 6: Manage your payments

Choose the most suitable payment method and set up a budget to ensure responsible spending.

Tip 7: Explore additional support

Seek advice from Citizens Advice, Shelter, or other organizations for additional financial assistance or debt management.

Tip 8: Stay informed

Keep up-to-date with Universal Credit policies and changes through official channels like Gov.uk.

Universal Credit: Essential Guide To Understanding And Claiming Benefits

Universal Credit (UC) is the UK government's primary welfare system, which combines six previous benefits into a single monthly payment. Understanding and claiming UC can be intricate, so here are some essential aspects to help navigate the process:

- Eligibility: Identifying who can claim UC based on age, residency, employment, and income.

- Application: Understanding the application process, including documentation and evidence required.

- Assessment: The assessment process to determine the amount of UC to be awarded.

- Payments: Frequency, amount, and payment methods for receiving UC.

- Conditionality: Requirements and responsibilities for UC claimants, such as job searching and training.

- Changes: How to report changes in circumstances that may affect UC entitlement.

These key aspects further explore the complexities of UC. Eligibility criteria, for instance, consider factors such as household composition, income, and savings. The application process involves submitting a detailed claim form and providing supporting documents. The assessment determines the claimant's UC award based on factors like income, housing costs, and childcare expenses. Understanding these aspects empowers individuals to effectively navigate the UC system and access the financial support they need.

authorization letter receive passport ledger paper sample examples word - Source www.pinterest.com.au

Universal Credit: Essential Guide To Understanding And Claiming Benefits

"Universal Credit: Essential Guide To Understanding And Claiming Benefits" is an invaluable tool for those seeking to delve into the intricacies of the Universal Credit system. This essential guide adeptly demystifies the complexities of Universal Credit, providing a comprehensive roadmap for understanding and leveraging its benefits. From eligibility criteria to the application process, it establishes a firm foundation for effective navigation of this multifaceted system.

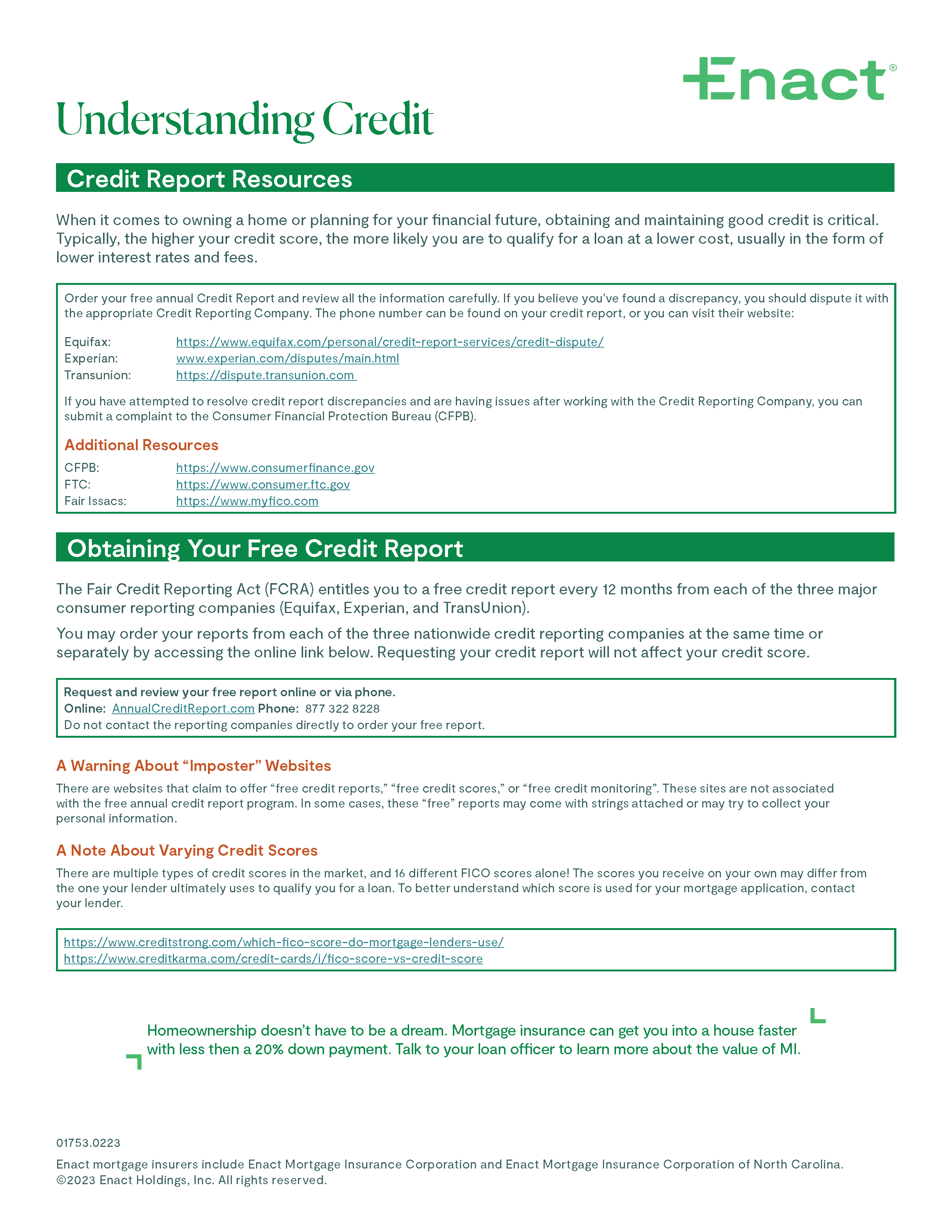

Help for FTHBs: Understanding Credit, Credit Scores, and Credit Reports - Source blog.enactmi.com

As a cornerstone of the UK's welfare system, Universal Credit plays a pivotal role in supporting individuals and families with low incomes or those facing financial hardship. Understanding the intricacies of Universal Credit is crucial for ensuring access to the financial assistance it provides. This guide meticulously dissects the system's components, clarifying eligibility criteria, explaining the application process, and outlining available support services. It empowers individuals with the knowledge to proactively engage with the system, maximizing their chances of securing the benefits they are entitled to.

Through real-life examples and practical guidance, this guide transforms complex concepts into tangible and relatable scenarios. It illuminates the practical significance of understanding Universal Credit, demonstrating how it can alleviate financial burdens, improve living conditions, and provide a pathway out of poverty. By fostering a comprehensive understanding of the system, individuals can proactively advocate for their rights and access the support they need to navigate life's challenges.

Expanding beyond mere theoretical knowledge, this guide provides a practical understanding of Universal Credit's impact on everyday life. It explores the role of Universal Credit in supporting housing costs, childcare expenses, and job search endeavors. By shedding light on the practical applications of Universal Credit, individuals can make informed decisions about accessing and utilizing its benefits, ultimately improving their financial well-being and overall quality of life.

Conclusion

"Universal Credit: Essential Guide To Understanding And Claiming Benefits" emerges as an indispensable resource for navigating the complexities of the UK's welfare system. Its comprehensive approach empowers individuals with the knowledge and tools to unlock the benefits they are entitled to, transforming abstract concepts into actionable steps toward financial empowerment.

By dispelling confusion and providing practical guidance, this guide sets the stage for a more equitable and accessible welfare system. It is a testament to the transformative power of knowledge, empowering individuals to take control of their financial futures and break the cycle of poverty. As the landscape of welfare support continues to evolve, this guide will undoubtedly remain a steadfast companion for those seeking to navigate its intricacies with confidence and success.