Tax Warning: Ensure Your HMRC Bank Account Details Are Up To Date

Editor's Notes: "Tax Warning: Ensure Your HMRC Bank Account Details Are Up To Date" have published today date". Give a reason why this topic important to read.

We analyzed information and put together this Tax Warning: Ensure Your HMRC Bank Account Details Are Up To Date guide to help target audience make the right decision.

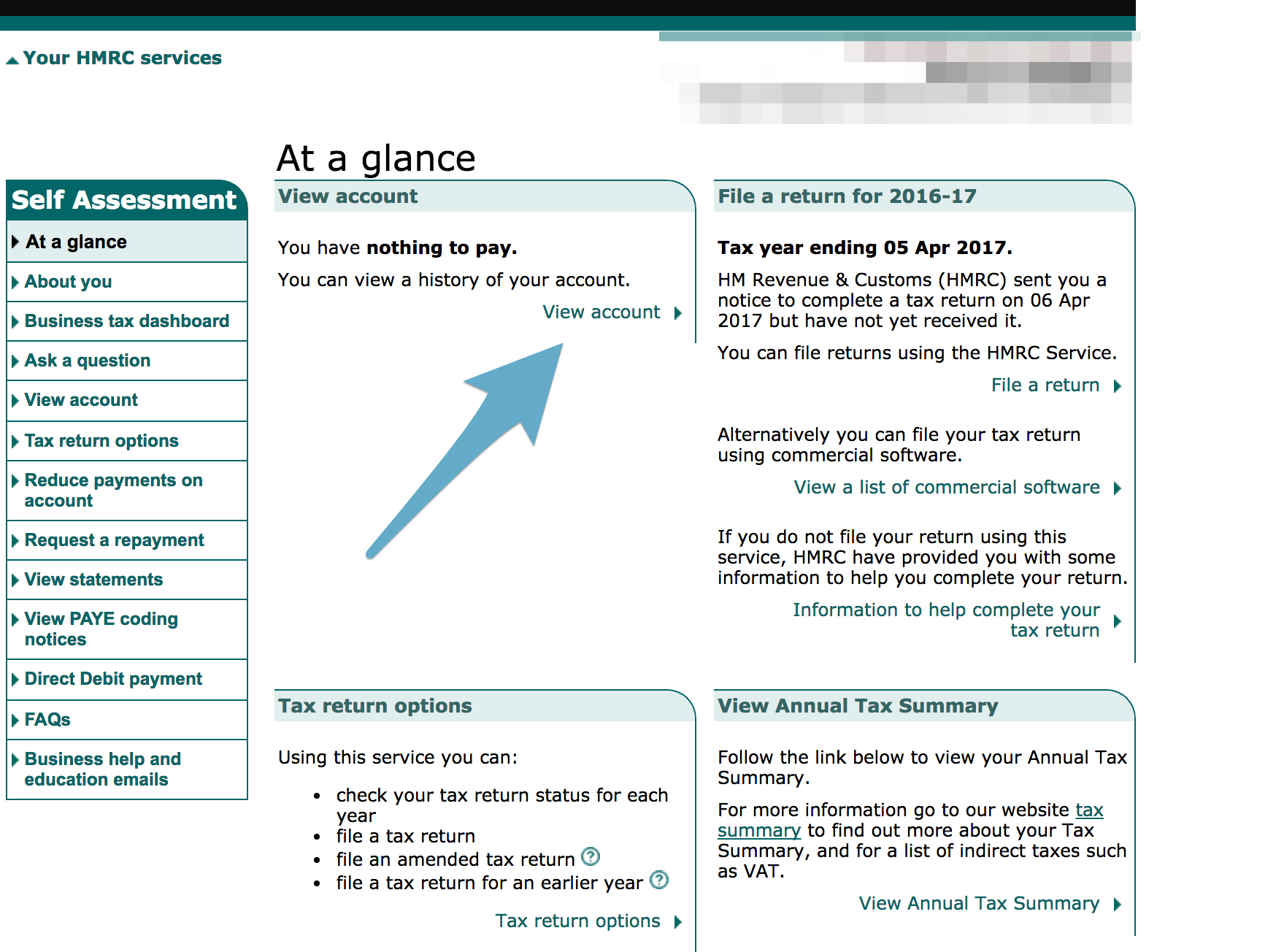

How to print your SA302 or Tax Year Overview from HMRC | Love - Source www.loveaccountancy.co.uk

FAQ

Individuals must verify and update their bank account information with HMRC immediately to guarantee timely receipt of tax credits and avoid potential delays or interruptions. This article aims to address frequently asked questions (FAQs) regarding this matter, ensuring a comprehensive understanding of the significance of maintaining up-to-date account details.

uk-hmrc-tax-documents - Source fakeutilities.com

Question 1: Why is it crucial to update HMRC bank account details?

Updating HMRC bank account details is essential to ensure the smooth and timely transfer of tax credits, including benefits such as Child Tax Credit and Working Tax Credit. Outdated or incorrect account information can result in delays or disruptions in payment, leading to financial inconvenience.

Question 2: How can I update my HMRC bank account details?

Updating HMRC bank account details can be done through various methods. Individuals can update their information online via the HMRC website, using the Government Gateway service. Alternatively, they can contact HMRC directly by phone or mail using the contact details provided on the official HMRC website.

Question 3: What information is required to update my HMRC bank account details?

To successfully update HMRC bank account details, individuals will need to provide their bank account number, sort code, and the name of the account holder. It is essential to ensure that the account details provided match the details registered with the bank. Any discrepancies may result in payment delays or errors.

Question 4: Are there any deadlines for updating HMRC bank account details?

Individuals are advised to update their HMRC bank account details as soon as possible to avoid any potential delays or interruptions in tax credit payments. There is no specific deadline set by HMRC for updating bank account details. However, it is recommended that individuals act promptly to ensure timely receipt of their tax credits.

Question 5: What should I do if I have not received my tax credits after updating my bank account details?

If individuals have updated their HMRC bank account details but have not received their tax credits within the expected timeframe, they should contact HMRC directly. HMRC will investigate the matter and provide assistance in resolving any issues that may have caused the delay in payment.

Question 6: Where can I find more information and support regarding updating my HMRC bank account details?

Individuals can find more information and support regarding updating their HMRC bank account details on the official HMRC website. The website provides comprehensive guidance, FAQs, and contact details for HMRC's customer support team. Additionally, individuals can seek assistance from tax advisors or financial professionals if they encounter any difficulties or have specific queries.

Maintaining up-to-date HMRC bank account details is crucial for the timely and efficient receipt of tax credits. Individuals should prioritize updating their account information and seek assistance from HMRC or other relevant sources if they encounter any challenges. By adhering to these guidelines, individuals can ensure they receive their tax credits without any delays or disruptions.

For further updates and information on tax-related matters, refer to the official HMRC website or consult with tax professionals.

Tips

HMRC has issued a warning to taxpayers to ensure that their bank account details are up to date. This is to prevent potential delays in receiving refunds or other payments.

Tax Warning: Ensure Your HMRC Bank Account Details Are Up To Date

Tip 1: Check your HMRC online account to verify your bank account details.

Tip 2: If you have recently changed banks or account numbers, update your details with HMRC as soon as possible.

Tip 3: Ensure that the name on your bank account matches the name registered with HMRC.

Tip 4: If you are unsure about your bank account details, contact HMRC directly.

Tip 5: Keep your HMRC online account information secure by using a strong password and enabling two-factor authentication.

Summary:

It is crucial to keep your HMRC bank account details up to date. This will ensure that you receive any refunds or payments promptly. Regularly review your details and update them if necessary. By following these tips, you can avoid potential delays and ensure that your tax affairs are in order.

Transition to the article's conclusion:

By following these simple steps, you can ensure that your HMRC bank account details are up to date and that you receive any refunds or payments due to you promptly.

Tax Warning: Ensure Your HMRC Bank Account Details Are Up To Date

Ignoring warnings about updating bank account details with HMRC can lead to severe consequences, including financial loss and legal issues. It is crucial to address this matter promptly to avoid potential complications.

- Accuracy: Provide correct and up-to-date bank account information.

- Timeliness: Respond to HMRC notices promptly to avoid delays in processing refunds or payments.

- Security: Protect personal and financial data by updating bank account details securely through official HMRC channels.

- Responsibility: Taxpayers are responsible for ensuring their bank account details are accurate.

- Consequences: Incorrect or outdated bank account details can result in delays, penalties, or even legal action.

- Convenience: Updating bank account details online or through other convenient methods simplifies tax management.

Taxpayers should be vigilant in maintaining accurate bank account information with HMRC. Failing to do so can hinder the smooth flow of tax-related transactions and lead to unnecessary complications. By addressing this issue in a timely and responsible manner, individuals can ensure their tax affairs are in order and avoid potential pitfalls.

Tax Warning: Ensure Your HMRC Bank Account Details Are Up To Date

The "Tax Warning: Ensure Your HMRC Bank Account Details Are Up To Date" serves as a vital reminder of the importance of maintaining accurate and up-to-date financial information with HMRC. This is crucial for the smooth processing of tax refunds, ensuring that taxpayers receive their due entitlements promptly and efficiently. Conversely, outdated bank account details can lead to delays, complications, and potential overpayments or underpayments of taxes.

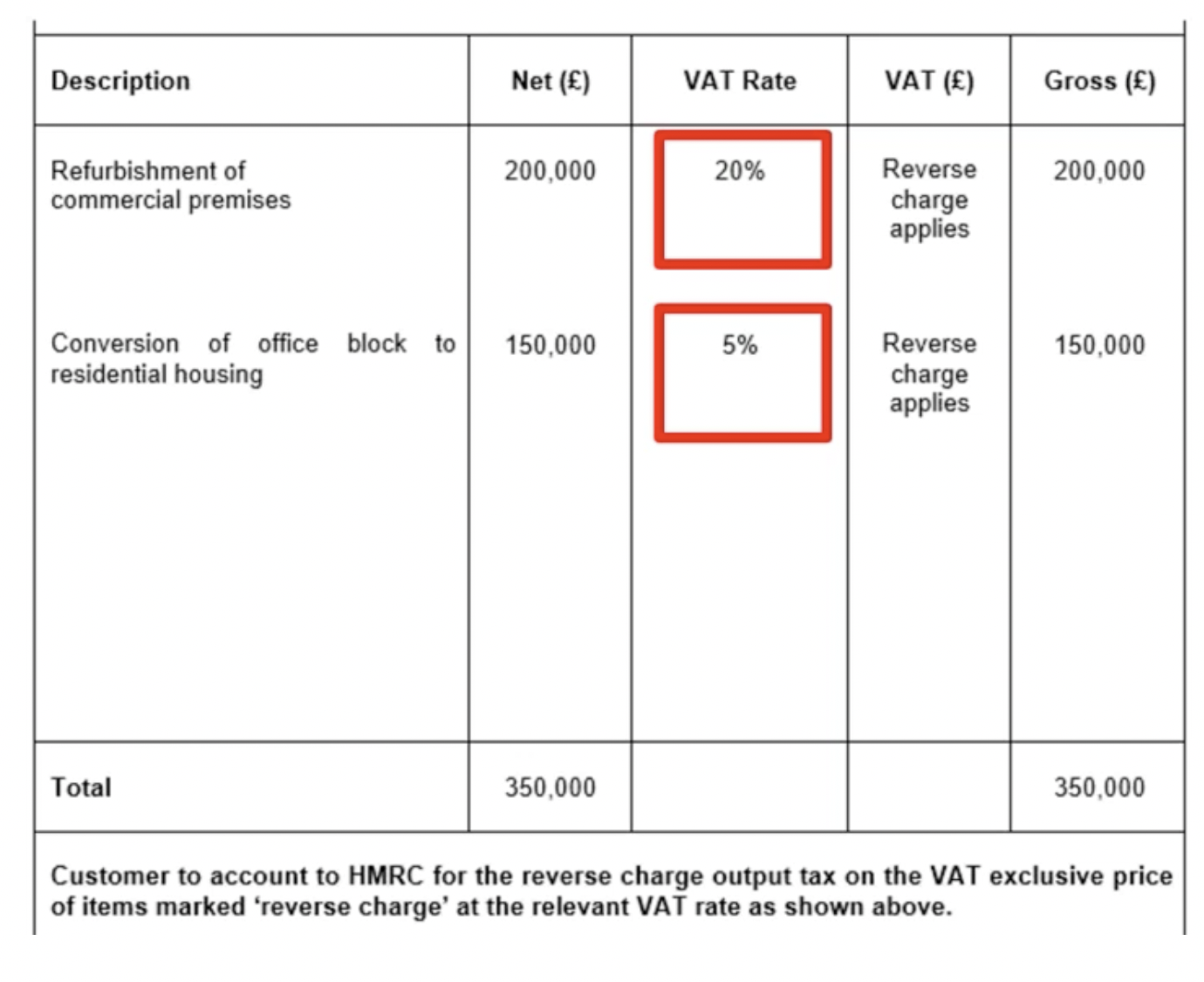

Hmrc Invoice Template – PARAHYENA - Source www.parahyena.com

Real-life examples abound of the consequences of neglecting to update bank account details with HMRC. In one instance, an individual who had moved house failed to inform HMRC of their new address. As a result, their tax refund was sent to their old address and was never received. In another case, a taxpayer who had recently switched banks also neglected to update their details with HMRC. Consequently, their tax payments continued to be deducted from their old account, leading to an overpayment situation.

Practical considerations dictate that taxpayers should make it a priority to keep their HMRC bank account details up to date. This can be done by logging into their HMRC online account or by contacting HMRC directly. The benefits of timely updates extend beyond ensuring the smooth flow of tax refunds and payments. It also minimizes the risk of fraud and identity theft, as unauthorized individuals may attempt to exploit outdated information to divert funds intended for legitimate taxpayers.

In conclusion, the "Tax Warning: Ensure Your HMRC Bank Account Details Are Up To Date" underscores the significance of maintaining accurate financial information with HMRC. Taxpayers who fail to heed this warning may face unnecessary delays, complications, and financial setbacks. By keeping their bank account details up to date, taxpayers can ensure the efficient and secure administration of their tax affairs.

Conclusion

The exploration of "Tax Warning: Ensure Your HMRC Bank Account Details Are Up To Date" underscores the paramount importance of accurate and up-to-date financial information for seamless tax administration. Taxpayers must prioritize maintaining current bank account details with HMRC to avoid delays, complications, and potential financial losses.

Beyond individual responsibility, this warning serves as a reminder of the broader obligation to contribute to the integrity of the tax system. Accurate bank account information ensures the efficient allocation of tax revenues, minimizing the risk of fraud and ensuring that public funds are utilized effectively.