After thorough analysis, digging information, made NatWest Bank Branch Closures: Impact On Customers, Economy, And Community Services we put together this informative guide to help target audience make the right decision.

FAQ

This FAQ section provides answers to commonly asked questions regarding the potential implications of NatWest Bank branch closures on customers, the economy, and community services.

Santander bank branch closures | Duncan Baker - Source www.duncanbaker.org.uk

Question 1: How will these branch closures affect customers who rely on in-person banking services?

Customers may experience reduced access to physical banking facilities and face inconvenience when conducting transactions. However, banks are expected to provide alternative options, such as online and mobile banking, as well as partnerships with other financial institutions.

Question 2: What are the potential economic consequences of branch closures?

Branch closures can limit access to local financial services and impact local businesses and communities, potentially leading to reduced economic activity and job losses.

Question 3: How will the closures affect the availability of community services?

Bank branches often serve as community hubs, providing access to financial advice and support. Closures could reduce access to these services and impact vulnerable individuals who rely on them.

Question 4: What is the rationale behind these closures?

Banks cite factors such as changing customer preferences towards digital banking and declining branch usage as justifications for closures.

Question 5: Are there any plans to mitigate the negative impacts?

Banks may implement measures to support affected customers, such as extending support hours for digital services and providing financial literacy programs to promote digital banking adoption.

Question 6: What are the long-term implications of branch closures for the banking industry?

Branch closures could further accelerate the shift towards digital banking, potentially altering the competitive landscape and reshaping the role of physical branches in the future.

The effects of NatWest Bank branch closures are multifaceted, with implications for customers, the economy, and community services. It remains crucial to monitor the situation and explore strategies to address any negative impacts while supporting the transition to alternative banking channels.

Next: Impact on the Financial Industry

Tips

The closure of NatWest Bank Branch Closures: Impact On Customers, Economy, And Community Services branches has significant implications for customers, the economy, and community services. Here are some tips to mitigate the impact:

Tip 1: Explore Alternative Banking Options: Consider using online banking, mobile apps, or other branch locations within a reasonable distance. These options offer convenience and accessibility.

Tip 2: Utilize Community Resources: Engage with local community organizations that provide financial support and assistance, such as credit unions or community development corporations.

Tip 5: Advocate for Small Businesses: Support initiatives aimed at helping small businesses affected by branch closures, such as promoting local spending or providing financial assistance.

By implementing these tips, individuals and communities can mitigate the impact of bank branch closures and ensure continued access to essential financial services.

NatWest Bank Branch Closures: Impact On Customers, Economy, And Community Services

NatWest Bank branch closures have been a topic of concern, with many exploring the diverse implications for customers, the economy, and community services.

- Reduced Access: Branch closures limit physical access to banking services, especially for customers reliant on in-person interactions.

- Economic Impact: Business closures affect local economies, reducing employment opportunities and diminishing the vibrancy of communities.

- Community Vitality: Branches serve as social hubs, offering support and advice, which may be lost with closures.

- Digital Divide: The shift to digital banking may exacerbate the digital divide, leaving vulnerable customers disadvantaged.

- Vulnerable Customers: Elderly, low-income, and disabled individuals often depend on branch services and may face challenges with alternatives.

- Business Impact: Small businesses may lose convenient access to banking services and face obstacles in conducting transactions.

The impact of branch closures is multifaceted, encompassing the loss of personal interaction, economic repercussions, and the erosion of community support. Understanding these aspects is crucial for mitigating the negative consequences and preserving the accessibility and vitality of banking services.

Interior Inside of Natwest Bank High Street Branch Showing Counter with - Source www.dreamstime.com

NatWest Bank Branch Closures: Impact On Customers, Economy, And Community Services

The decision by NatWest to close a significant number of its bank branches has sparked concerns about the impact on customers, the economy, and community services. These closures are part of a wider trend in the banking sector, as banks increasingly move towards digital and online banking services. While digital banking offers convenience and accessibility, the closure of physical branches can have a range of negative consequences.

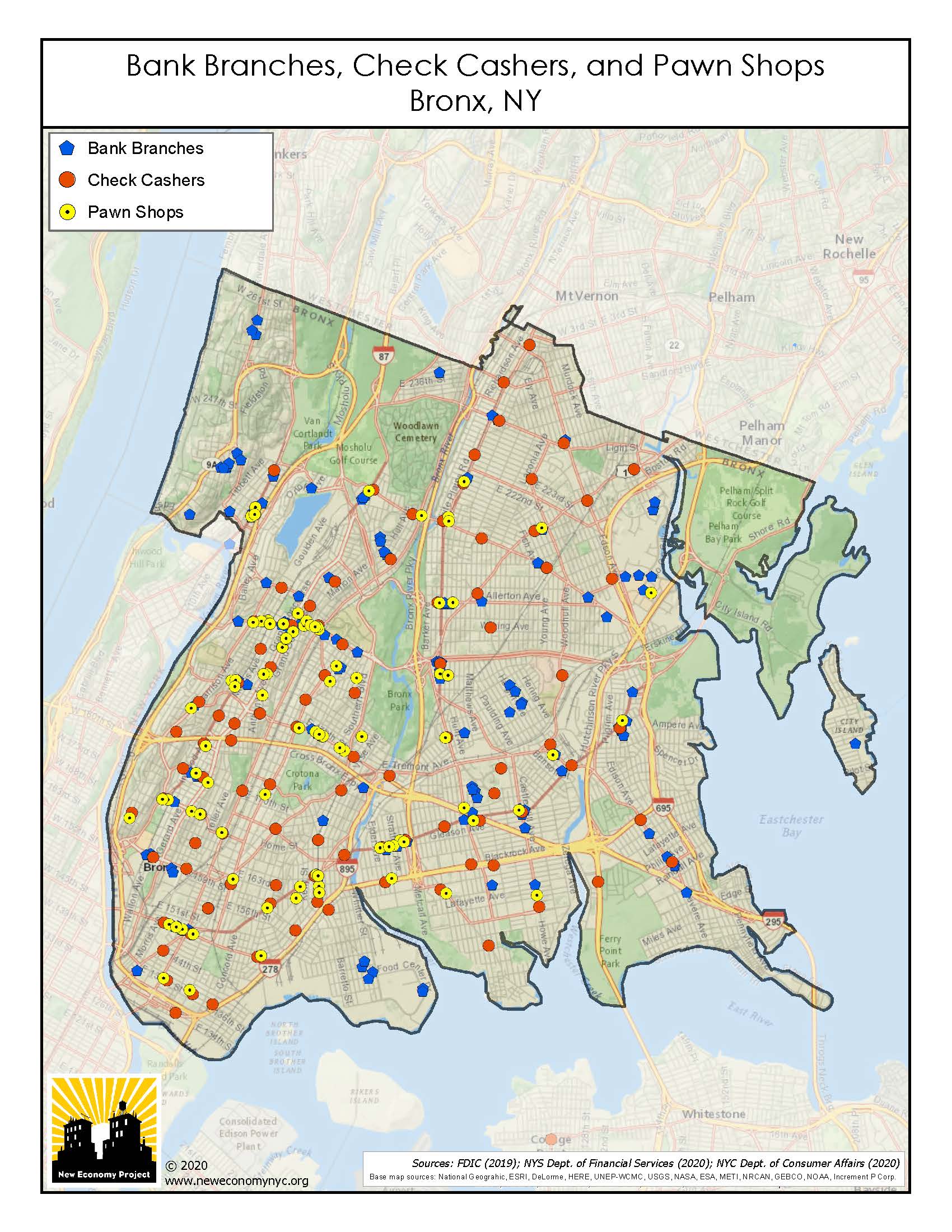

How Branch Closures Impact Hard Hit Communities | Association for - Source anhd.org

One of the primary concerns is the impact on customers, particularly those who rely on in-person banking services. The elderly, disabled, and those living in rural areas may find it difficult to access alternative banking services, such as online or mobile banking. This can lead to financial exclusion and a loss of access to essential financial services.

The closures can also have a negative impact on the local economy. Banks play an important role in providing financial services to businesses and individuals, and their closure can lead to a loss of investment and economic activity. In some cases, the closure of a bank branch can lead to a decline in property values and a loss of jobs.

Finally, the closure of bank branches can also have a negative impact on community services. Banks often provide meeting spaces for community groups and charities, and their closure can lead to a loss of these valuable spaces. This can have a negative impact on social cohesion and community well-being.

Conclusion

The decision by NatWest to close a significant number of its bank branches has raised important concerns about the impact on customers, the economy, and community services. While digital banking offers convenience and accessibility, the closure of physical branches can have a range of negative consequences, including financial exclusion, economic decline, and a loss of community services. It is important for banks to consider the impact of branch closures on their customers and communities and to work with local stakeholders to mitigate the negative effects.

The closure of bank branches is a complex issue with no easy solutions. However, by working together, banks, regulators, and community groups can find ways to minimize the negative impact of branch closures and ensure that everyone has access to the financial services they need.