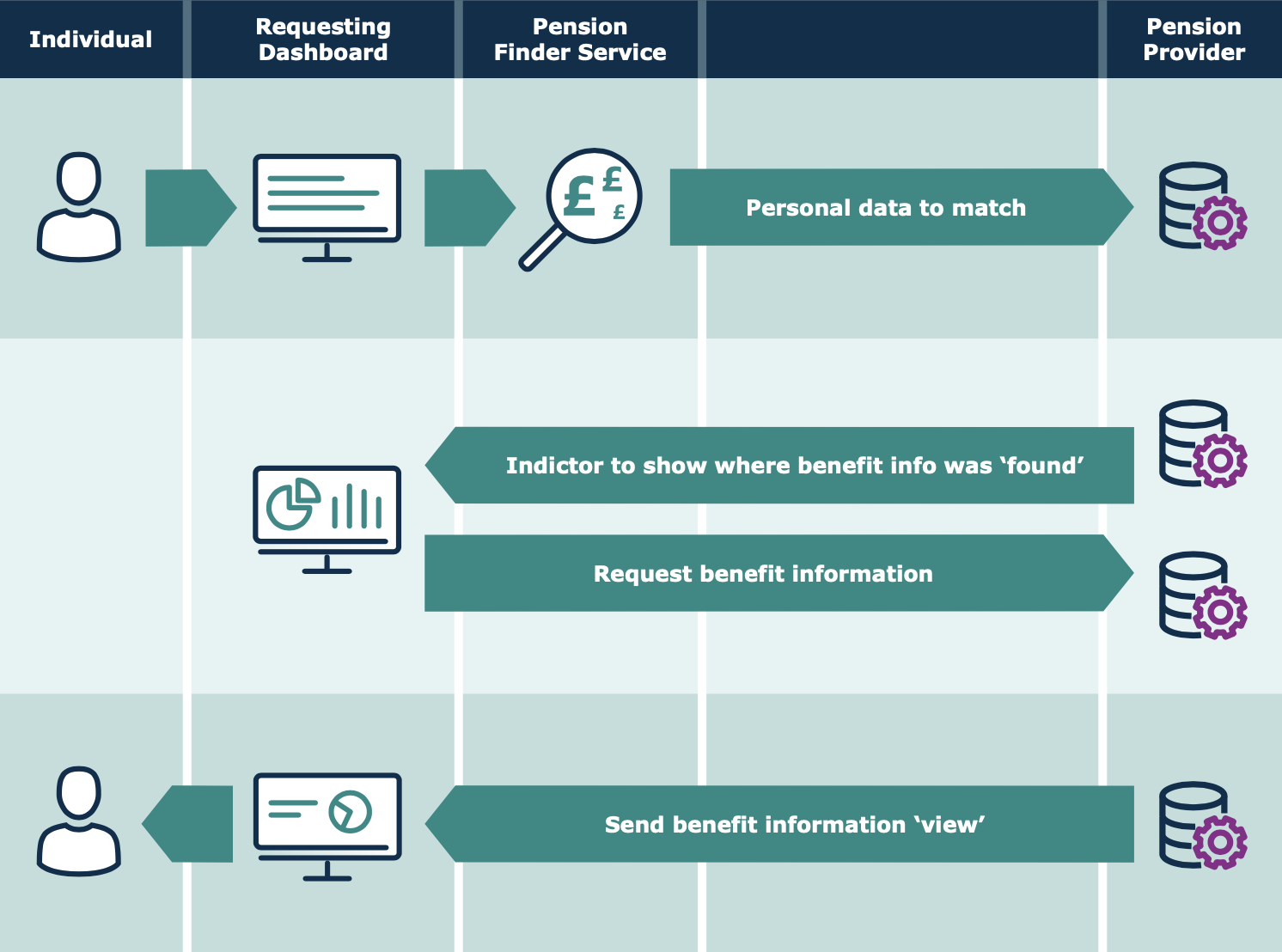

Pensions Dashboards to include estimated retirement income - Source professionalparaplanner.co.uk

| Bağkur Retirement Pensions | Other Retirement Pensions | |

|---|---|---|

| Eligibility | Self-employed individuals and tradespeople | Employees and civil servants |

| Contributions | Monthly premiums paid by the individual | Contributions shared between the employee and employer |

| Benefits | Monthly pension payments, healthcare coverage, and other benefits | Similar benefits, but may vary depending on the specific pension scheme |

- Eligibility for Bağkur Retirement Pensions

- Calculating Bağkur Retirement Pensions

- The Application Process for Bağkur Retirement Pensions

- Conclusion

FAQ

This comprehensive guide provides in-depth information on Bağkur retirement pensions, including eligibility requirements, pension calculations, and the application process. The following frequently asked questions (FAQs) address common concerns and misconceptions to provide a clear understanding of the topic:

(Free Download) FMLA Eligibility Checklist - AIHR - Source www.aihr.com

Question 1: Who is eligible for a Bağkur retirement pension?

To be eligible for a Bağkur retirement pension, individuals must have made regular and sufficient premium payments, reached the minimum retirement age, and meet certain citizenship and residency requirements.

Question 2: How is the Bağkur retirement pension calculated?

The Bağkur retirement pension is calculated based on the average monthly premium paid over a specific period and the number of years of premium payments made.

Question 3: When can individuals apply for a Bağkur retirement pension?

Individuals can apply for a Bağkur retirement pension within three months of meeting the eligibility criteria.

Question 4: What documents are required for Bağkur retirement pension applications?

The required documents vary depending on individual circumstances but may include proof of citizenship, residency, and income.

Question 5: What is the process for appealing a Bağkur retirement pension decision?

Individuals can appeal a Bağkur retirement pension decision by submitting a written request to the relevant authorities within the specified time period.

Question 6: What are the benefits of receiving a Bağkur retirement pension?

The Bağkur retirement pension provides financial security during retirement, ensuring a stable income to meet living expenses.

Understanding these FAQs can empower individuals to make informed decisions about their Bağkur retirement pensions. It is essential to seek professional guidance as needed to ensure a smooth and successful application process.

Tips for Utilizing Bağkur Retirement Pensions

Understanding the Bağkur Retirement Pension system can be complex. Here are some tips to help you make the most of your pension benefits:

Tip 1: Determine Eligibility Requirements

To qualify for a Bağkur Retirement Pension, you must have at least 10 years of Bağkur premiums paid and be at least 55 years old for women or 60 years old for men Discover The Comprehensive Guide To Bağkur Retirement Pensions: Eligibility, Calculations, And Application Process. It is important to verify your eligibility early on to ensure you meet the necessary criteria.

Tip 2: Calculate Estimated Pension Amount

The amount of your Bağkur Retirement Pension is based on your average income during your last seven years of Bağkur contributions. Use the official calculation formula or an online calculator to estimate your potential pension amount. This will help you plan for your retirement expenses.

Tip 3: Apply for Pension on Time

It is crucial to apply for your Bağkur Retirement Pension as soon as you meet the eligibility requirements. There is a five-year statute of limitations from the date you become eligible. Missing this deadline can result in lost benefits.

Tip 4: Gather Required Documents

The application process for a Bağkur Retirement Pension requires various documents, such as your identity card, Bağkur premium payment records, and proof of income. Make sure you have all the necessary documents organized to avoid delays in processing.

Tip 5: Keep Track of Pension Payments

Once your Bağkur Retirement Pension is approved, it is important to keep track of your payments. If you notice any discrepancies or delays, contact the Social Security Institution (SGK) immediately to resolve the issue and ensure timely receipt of your benefits.

By following these tips, you can navigate the Bağkur Retirement Pension system effectively and maximize your retirement benefits.

To learn more about Bağkur Retirement Pensions and the application process, refer to the Discover The Comprehensive Guide To Bağkur Retirement Pensions: Eligibility, Calculations, And Application Process for further details.

Discover The Comprehensive Guide To Bağkur Retirement Pensions: Eligibility, Calculations, And Application Process

Understanding the intricacies of Bağkur retirement pensions is crucial for individuals seeking financial security during their golden years. This guide will explore the essential aspects to provide you with a thorough understanding of eligibility criteria, calculation methods, and the application process.

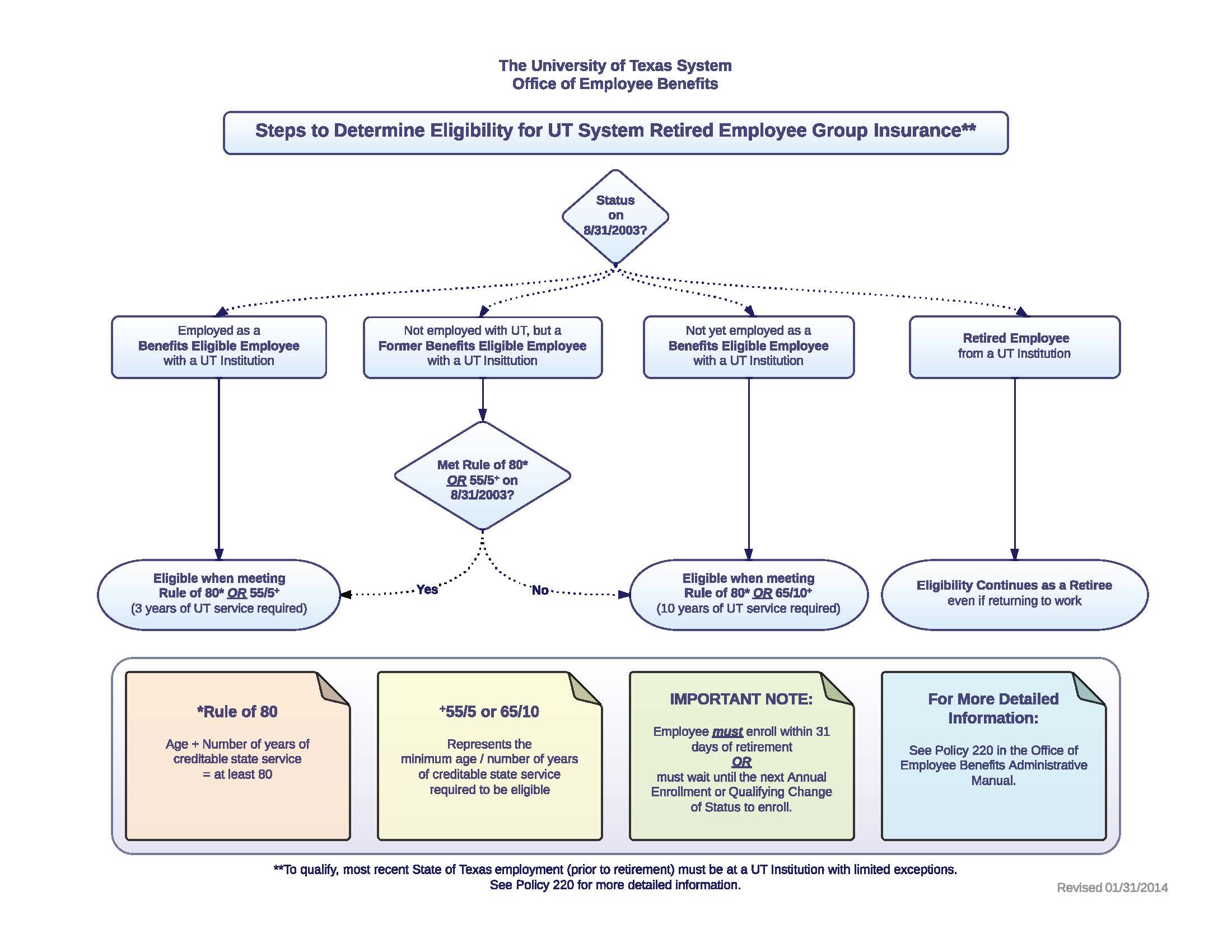

Retirement Eligibility Flowchart | University of Texas System - Source www.utsystem.edu

These aspects play a pivotal role in ensuring a secure retirement. Understanding eligibility criteria prevents individuals from any future discrepancies or delays in receiving their pensions. The calculation methods provide clarity on how pension amounts are determined, fostering transparency and financial planning. The application process outlines the necessary steps, reducing potential errors and expediting approval. By considering these key aspects, individuals can make informed decisions, maximize their retirement savings, and plan for a comfortable retirement.

Discover The Comprehensive Guide To Bağkur Retirement Pensions: Eligibility, Calculations, And Application Process

This guide provides comprehensive information on Bağkur retirement pensions, encompassing eligibility criteria, calculation methodologies, and application procedures. Understanding these aspects is crucial for individuals seeking to establish and claim their pension entitlements.

The Ultimate Guide To Statutory Retirement Pensions In Poland - Source thesportnews.pages.dev

The guide delves into the various eligibility requirements for Bağkur pensions, considering factors such as age, contribution periods, and occupational status. It clarifies the calculation process used to determine pension amounts, ensuring a clear understanding of the factors and formulas involved. Moreover, the guide provides step-by-step instructions on the application process, including necessary documentation and timelines, empowering individuals to navigate the process effectively.

By equipping readers with in-depth knowledge of Bağkur retirement pensions, this guide enables them to make informed decisions regarding their retirement planning and financial security. It empowers individuals to assess their eligibility, calculate potential pension amounts, and initiate the application process with confidence.

Conclusion

This comprehensive guide has illuminated the intricacies of Bağkur retirement pensions, providing invaluable insights into eligibility, calculations, and the application process. By empowering individuals with this knowledge, they can proactively plan for their retirement and secure their financial well-being.

Understanding the nuances of Bağkur pensions is not merely a technical exercise but a crucial step towards financial security and peace of mind. This guide serves as a valuable resource, enabling individuals to navigate the complexities of the pension system with confidence and maximize their retirement benefits.